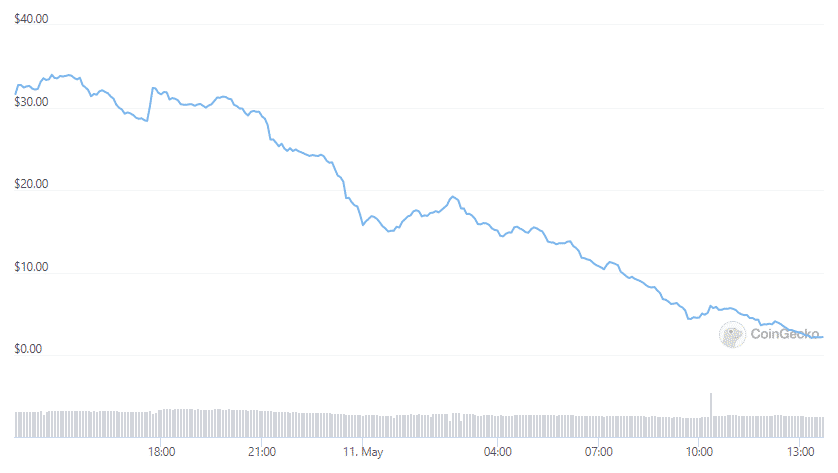

LUNA slides by 32% in an hour while the UST stablecoin remains depegged as we can see further in today’s latest altcoin news.

Terra’s LUNA token continues to take a beating today as LUNA slides by 32% in an hour and 65% in the past 24 hours. The coin is now trading at $17.71 according to the data from Coingecko. LUNA was trading at around $65 a few days ago but then it started collapsing as the dollar stablecoin UST lost its peg. UST dropped to below $0.70 and was struggling to get back on parity with the dollar so after the partial recovery to $0.93 it dropped back to under $0.75.

Terra’s co-founder Do Kwon noted that he was close to announcing a recovery plan for UST and a recovery plan will affect LUNA as well. UST is designed to retain its $1 peg because of the complex algorithmic strategy which involves burning UST to mint LUNA and as the value of both spirals downwards, the strategy fell apart. UST’s fall renewed calls from US government officials for stablecoin regulations. Treasury Secretary Janet Yellen noted:

“A stablecoin known as TerraUSD experienced a run and declined in value. I think that this simply illustrates that this is a rapidly growing product and there are rapidly growing risks.”

Binance as the biggest crypto exchange by volume announced that it stopped withdrawals of Luna until it deemed the network to be stable and the volume of the withdrawals reduced.

As the crypto community tries to find out what terra’s ongoing depegging fiasco will bring as a consequence, the major crypto exchange Binance suspended UST and Luna withdrawals until furhter notice, as was announced on Tuesday. The market value of UST, Terra’s stablecoin offering fell below its expected $1 peg and LUNA experienced a sharp drop as well. At the same time, the BTC/UST trading par on Binance reached a new high of more than $42,000 while other BTC dollar markets struggled to preserve the $30,000 level.

As a measure against the uncertainy within the Terra ecosystem, Binance suspended all withdrawals for LUNA and UST tokens citing a high volume of pending withdrawal transactions. As per Binance, the high volume of pending UST transactions happened due to network slowness and congestion.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post