The Lido DAO is in overbought territory since April and the LDO prices are rallying by 150% in just two weeks so what seems to be driving the rally? Let’s find out today in our cryptocurrency’s latest news.

Ethereum 2.0 tentative launch back in September raised the LDO prospects of holding the gains. The price of Lido DAO dropped a day after the key momentum oscillator crossed into the overbought territory. The Lido DAO is in overbought territory and the price initially plunged to as low as $1.04 from $1.32 which amounted to a 20% drop. The token’s sharp downside move took cues from other bearish technical indicators like the daily relative strength index and the 100-day exponential moving average.

LDO’s latest drop came after it rallied over 150% in two weeks which is a move that pushed the daily RSI above 70 and turned into overbought. The overbought RSI shows that the rally could be coming to an end while preparing for a short-term pullback. In the meantime, more downside cues for the Lido DAO token cam from the 100-DAY EMA close to $1.30 which capped LDO from the 150% rally. In the initial stages, the price action looked similar to a correction after the RSI crossed near 70 for the first time in history. The Lido DAO token underwent a 90% price decline to hit $0.39 a new record low.

This increases the LDO potential to repeat the April correction but there’s no exact bottom in sight. With that being said, the token’s interim downside target seems to be near the 50-day EMA down by 20% from today’s prices. On the other hand, breaking below the 50-Day EMA will risk crashing the coin to On the other hand, breaking below the 50-Day EMA will risk crashing the coin to $0..

buy vigora online https://hiims.in/kidneycare/assets/fonts/flaticon/new/vigora.html no prescription

74 which coincides with the 0.618 Fib line down from the $0.39 low to $1.31 swing high. The Ethereum developers confirmed that their upcoming transition to proof of stake dubbed the Merge will occur on September 19.

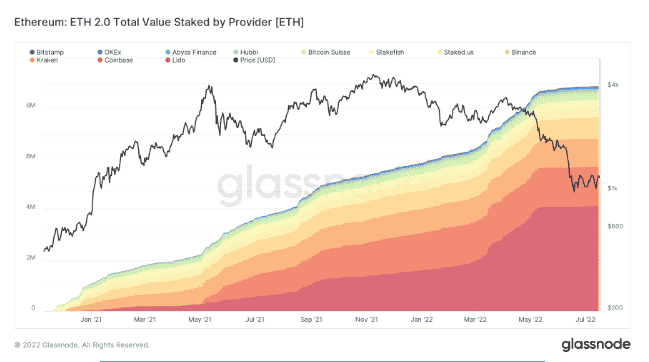

LDO surged 25% on the day of the announcement because of its close ties with Etheruem. LDO serves as a governance token at Lido which locked over 4.13 million ETH into the Merge smart contract. After the Ethereum announcement, the number of Ether deposited into the Merge smart contract via Lido increased. With Lido now being the biggest provider by total value staked, a merge launch can brign more users to lido which can also boost the demand.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post