LEND shoots up another 11% by 11.28 percent to $0.858 per token which is the highest level to this date in the upcoming altcoin news today.

The Decentralized finance asset LEND continued the price rally ahead of the New York opening bell Wednesday as its peers across the crypto space suffered intraday losses. The 21st largest cryptocurrency surged 11.28 percent to the $0.858 level which is the highest level to this date.

buy clomid online https://rxbuywithoutprescriptiononline.net/dir/clomid.html no prescription

The upside followed the four-week winning streak where the LEND/USD rallied from 0.369 to 0.858 which amounts to a 210 percent price jump.

Zooming out on the pair weekly chart, we can see a huge uptrend in play. LEND shoots up with its USD pair by as much as 29,422 percent after bottoming out at 0.003 in the middle of August last year. The bigger portion of the gains came after March 2020 hitting more than 80 percent of the total upside move.

buy zovirax online https://rxbuywithoutprescriptiononline.net/dir/zovirax.html no prescription

In the same period, there was a boom in decentralized finance space and almost all tokens played a critical role in managing the finances of the decentralized lending as well as oracle platforms and staking platforms which ended up in delivering more gains.

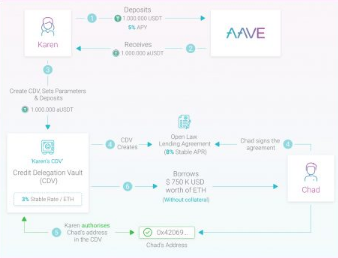

LEND surged because it surged as a governance token for Aave which is an open-source and non-custodial protocol which “enables users to earn interest on deposits and borrow assets with a variable or stable interest rate.” The hype became a real exploration of product-backed return of investments and a month ago, Aave announced the native Credit Delegation which is a service that allows LEND depositors to delegate their own credit lines as Messari commented:

“Overcollateralized lending is capital inefficient, and uncollateralized lending has been one of the key missing pieces to DeFi lending. Assuming it works it has the potential to significantly scale DeFi lending and could underpin many novel lending arrangements, leveraging Aave as a global source of capital.”

The new features helped Aave to turn the speculators into long term lend holders. This plays a huge role in subsidizing token’ bearish risks while aave’s growth as a Defi project kept attracting more higher bids for LEND, leading the total value locked into the reserves to a new high of $1.5 billion. Also, the UK financial regulator granted Aave the license to operate as a money services business. Despite the rally, LEND risked correcting lower because of its technically overbought bias. The token’s relative strength index flashed above 70 which is a level that separates the asset from the natural sentiment.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post