The LEND Defi token turns into AAVE and its started the transformation with a 25% price surge as we are reading more in today’s altcoin news.

In retrospect, the team behind Aave announced about two weeks ago that they will transfer the ownership of the lending protocol to a “genesis governance” built after a community vote. The ayes came during the upgrade of the protocol last week. LEND was the governance token from the previous Aave protocol and the team proposed to convert the old crypto asset to the one that will be more compatible with the genesis governance built which is how AAVE came into existence.

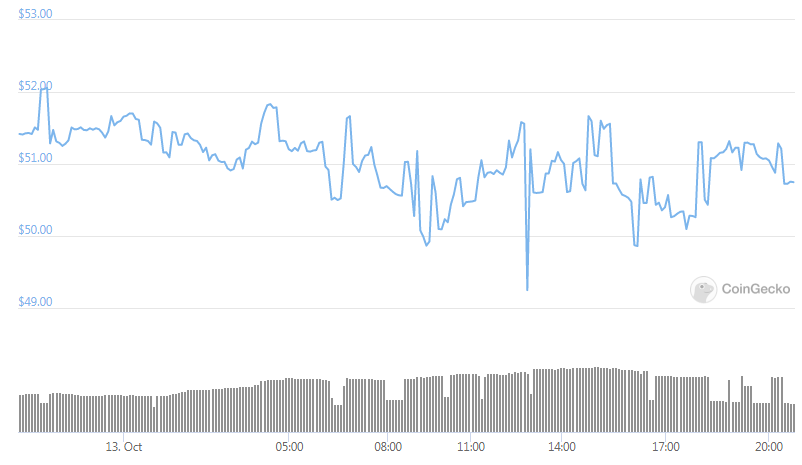

The so-called token swap started last week with a rate of 1 AAVE per 100 LEND. A few other exchanges integrated AAVE into their platforms which allowed traders to speculate on the value as they were doing with LEND. The first days of trading of the coin on Gemini were welcomed with explosive buyouts. The US exchange reported about a 23 percent increase in the early three days. After the natural downside correction later the AAVE/USD exchange rate resumed the uptrend and formed the local top about 25 percent higher at $54.99.

The gains came as the traders assessed that Aave will switch to a more decentralized protocol. It allowed the project to stand out among other lending and borrowing projects in the decentralized finance space. Profits for the new AAVe poured in alongside the market-wide rebound. A rally in the BTC market prompted alternative crypto assets to follow suit as it has happened over the history of altcoins.

The traders went long on LEND defi token trades after the project announced that it had received a high-profile monetary backing. Standard Crypto, Blockchain Capital, and Blockchain.com Ventures invested $25 million in Aave the latter announced on social media. Stani Kulechov, the CEO said that the company raised funds from investors in order to bring Defi closer to institutional use and to expand the team size to serve the growth in the Asian markets. He also added that these companies will participate in the staking and governance of the project which will require all three to hold the token.

Alex Saunders, the CEO, and co-founder of Nugget News AU explained that the backers of Aave have plans buy LEND in anticipation to secure about 100 times of the returns in the later stage, by adding:

“The future is bright.”

Eric Dadoun, an early-stage startup investor called the LEND token an undervalued gem by leaving more hints of an extended bull run behind. The token was trading at $52 at the time of the report.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post