JPMorgan sends primer on crypto to its private clients according to a report that was produced in February 2021, showing that the private bank requires a minimum balance of $10 million to open an account so let’s read more in our latest cryptocurrency news.

JPMorgan sends primer on crypto to its private clients to educate them on the risks and opportunities of investing in crypto. The report came after CNBC reported in February that the bank’s co-president Daniel Pinto claimed that the demand for crypto isn’t there yet from clients for crypto services but it eventually will get there.

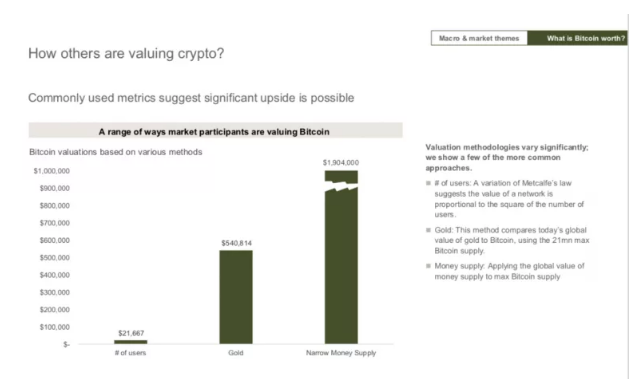

The report broke down how BTC could be valued by applying three different metrics like the value of gold, the global money supply, and the number of users. If we apply a version of Metcalfe’s law that the BTC value is proportional to the square of the number of users it would be worth $21,667. If we apply the current value of gold to the max supply of 21 million Bitcoin, the coin would be valued at $540,814. While if we apply the global value of money to BTC’s max supply, the place of the valuation would be set at $1.9 million. The report played down Bitcoin’s comparison to gold and despite its diversifying properties, Bitcoin’s volatility characteristics and correlation profile refute the comparison to the traditional safe-haven asset.

As reported previously, The giant US multinational investment bank could be among the next few entities to get involved with BTC. JPMorgan’s co-president Daniel Pinto said that while the demand for the number one cryptocurrency is not there yet, it will be at some point and the bank has to be prepared. Last year was quite important for BTC as the COVID-19 pandemic outlined the benefits to the traditional financial world and plenty of other individuals, corporations, and other institutions that praised it openly and admitted to allocating funds in the asset. BTC entered the new year with a bang and reached massive adoption milestones. These included a $1.5 billion purchase from Tesla and right after that the oldest bank in America, BNY Mellon announced custodian services as well. According to a CNBC report, these developments put pressure on Wall Street to get involved with the growing BTC trend and next in line is, of course, JPMorgan with $3 trillion in assets under management.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post