The investors dump on Terra 2.0 after the LUNA coin crashed by 70% in two days after the relaunch so let’s read more today in our latest altcoin news.

Lark Davis added:

“Zero plans to buy luna 2.0, but I will dump any airdrop if I get something on Binance.”

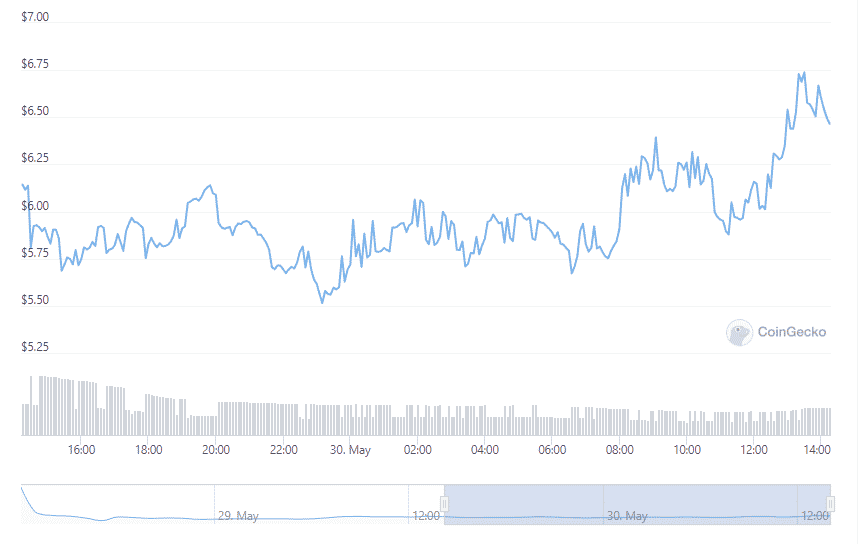

The price of LUNA tanked by 70% since the re-launch of the terra ecosystem and with the revival plan of tErraform Labs founder Do Kwon, the new Luna tokens referred to as Luna 2 were airdropped to investors which held LUNA classic, TerraUSD Classic, and Anchor Protocol UST. As per the data from CoinGecko, the LUNA token was airdropped by 69% since the opening of $18.87 and sits around $5.71 at the time of writing but Investors dump on Terra as it seems. At this stage, the biggest drop seems to suggest a lack of faith in Do Kwo’s revamp with most investors indicating that they are looking to recover a smaller portion of their lost capital and wipe their hands clean off the project.

Binance is set to start a multi-year distribution of LUNA to the eligible users by the end of May along with listing the token for trading in the Innovation Zone which is a dedicated zone for volatile and high-risk assets. Some people in the community that had plans to purchase LUNA when the carnage ended, predicted another bloodshed once the Binance Drop goes live. They pointed out that binance has up to 15.7MM liquid LUNA that will be available to the users on Tuesday and suggested that the investors that used the Anchor Protocol will look to cash out because they have no real interest in the Terra ecosystem. The influencers in the space like Lark Davis noted that:

“Zero plans to buy $luna 2.0, but I will dump any airdrop if I get something on Binance.”

The only reason to buy $LUNA 2.0 is to qualify for the next airdrop of $LUNA 3.0 after it goes to zero like $LUNA 1.0

— Luke Martin (@VentureCoinist) May 29, 2022

The new Nansen report claims seven wallets triggered the UST depeg and the lack of liquidity in the curve protocols securing the UST to other stablecoins initiated the price destabilization. Nansen pushed back on the idea of malicious attacks arguing the Terra meltdown could have been the result of the huge funds practicing risk management. The report argued that the on-chain metrics show wallets destabilized UST by selling large amounts of the coin into illiquid Curve liquidity pools but the reports pushed back against the idea that the collapse was brought on by a huge attack.

Sold my available LUNA 2.0 airdrop → ETH @ $1,790.

I don’t see any fundamental here & I see whatever I get as bonus since I already wrote everything off as a loss & $0.

If not that the others are vesting, I’ll sell ‘em all.

— 𝕎𝕠𝕝𝕗𝕗 (@0xWolff) May 28, 2022

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post