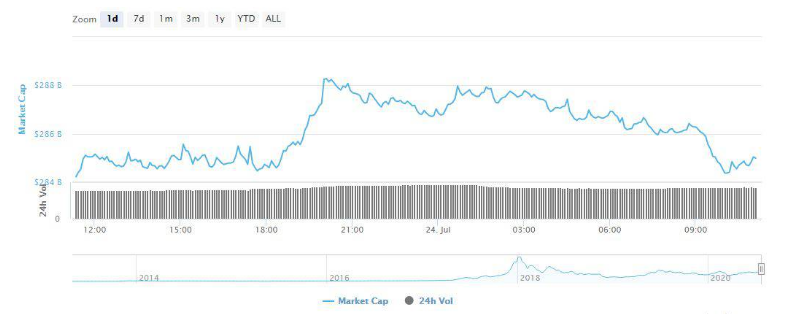

A huge crypto market cap loss occurred recently, reaching a loss of $4 billion right when Bitcoin started retracing to $9500 and brought most of the altcoins with it. In the latest altcoin news, we find out more about market analysis.

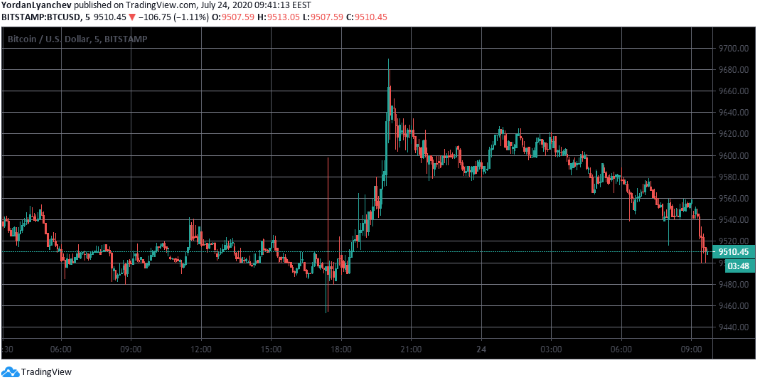

The huge crypto market cap loss of $4 billion in the past few hours poses a question of whether this is the only correction or a trend reversal? At the same time, the precious metal skyrocketed with record gains, especially the silver. Volatility returned again for Bitcoin this week after the weeks of stagnation as Bitcoin started breaking the resistance at $9300 and then continued towards $9500. Bitcoin’s intraday high jumped to $9,860 on Bitstamp where it got rejected and started instantly trading towards $9500 again which now serves as a support.

Ethereum is another digital asset that felt a huge burst of energy back to its performance as it was stuck at the $230 and $240 level for a few weeks. It then later jumped to $262 and continued to increase again to $277. The Second largest-coin by the market was not able to keep up with the bullish run and dropped to $270. Most of the other altcoins however were in the red. For example, Litecoin, Bitcoin SV, Bitcoin Cash all dropped by more than 1.5% since yesterday. Stellar and EOS lost more than 3% of their value.

Bitcoin could be following yesterday’s price drops among the biggest US-based stock market indexes as the S&P 500 went down by 1.23% and Dow Jones slumped by 1.31%. According to Tom Lee, the Managing Partner and Head of Research at Fundstrat Global Advisors, these results on Wall Street are to be expected. He warned that some similar developments could even go on as there is a lot to be worried about.

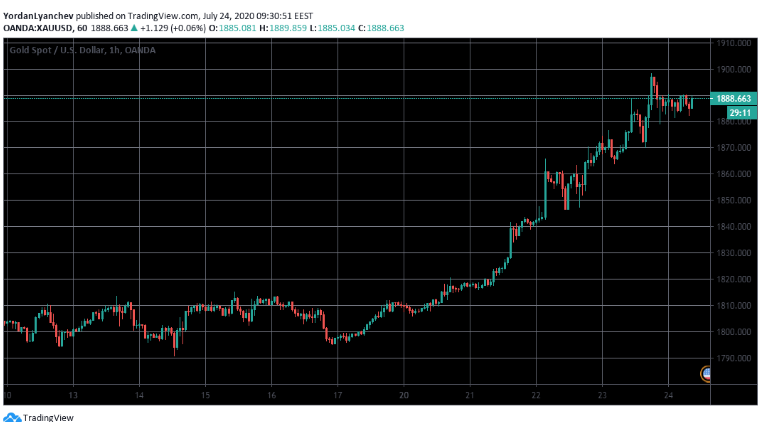

While the stocks dumped, the recent performance from gold and silver keeps on impressing the investors. The two precious metals are regarded as safe-haven investments and they all soared lately. Silver’s gains are now outperforming gold as it increased by 18% while its year-to-date high is nearly 30%. Gold increased as well especially since it reached $1800 per ounce last week, marking a 25% rise since the start of 2020. Other analysts believe that gold will pass its all-time high of $1920 before the year ends.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post