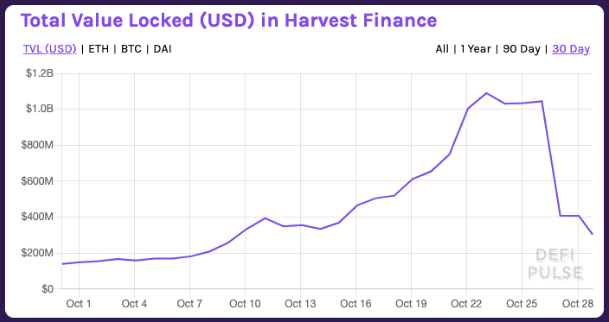

Harvest has more than $300 million in deposits after the huge $24 million exploit that led to the governance token dropping 65% of the value. Harvest Finance entered into a consolidation period ever since but deposits have surpassed $311 million. Following the latest developments, we are reading more in today’s altcoin news.

The deposits value is still a far cry from the $1 billion in TVL that the protocol saw last week but the quick recovery led many to believe that the platform still has chances to recover. Harvest Finance is the newest darling in the Defi ecosystem but it suffered an attack recently which devastated both the token value and entire security of the protocol. It did rise to fame in a few days and accumulated $1 billion in total value locked prior to the attack.

The hack took place last week when a skilled trader or hacker, took advantage of the shortcomings of the smart contracts and managed to drain about $24 million worth of stablecoins from the platform. The governance token FARM dropped from around $232 to $96 in minutes, losing 60% of the value. However, the security flaws of the attack vector in Harvests’ smart contracts haven’t stopped the yield farmers from withdrawing their funds completely from Harvest. The data shows that there are not around $311.7 million worth of deposits in Harvest.

Despite it currently holding about 30 percent from its value from two days ago, the native FARM token is being utilized still. About 78% of the circulating supply was staked on Harvest with the coin holding a market cap of just under $25.4 million. while it is too early to whether the platform could be able to pull out from the latest attack and get back to its pre-hack TVL, one thing is clear for sure, the protocol’s attractive APYs on farming various DeFi assets is what keeps the traders coming back for more.

As reported previously, Harvest Finance offers $1 million for hard evidence that leads to funds being returned. It hasn’t presented another plan for making affected users whole. The DeFi yield farming protocol is offering a $1 million bounties to find the hacker that stole $34 million from its users over the weekend. The attacker used a flash loan to deflate the prices of stablecoins like USDT and Tether on the platform and to steal the tokens at a bargain-basement price from the liquidity pools.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post