The harvest finance developers refuse to give up on the centralized control of $1 billion locked in the project as we can see in today’s cryptocurrency news.

Harvest finance developers responded to the centralization doubts that are highlighted in the audit reports as the funders took the stubborn stance for holding the admin keys of the project. The Time Lock period for implementing the changes to the project is the only safe way for investors right now. the explanation of the team said:

“No one can spend 1B, it’s not useful, it’s much better to have a project where people can benefit from it.”

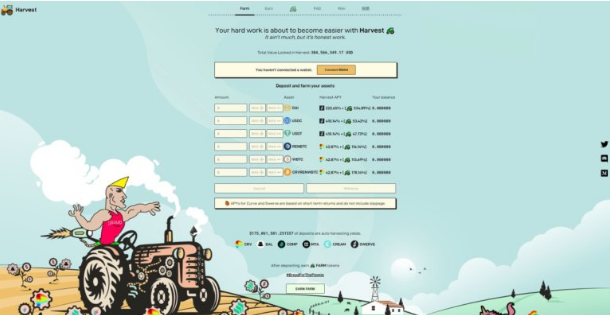

Within the fortnight of the launch, Harvest Finance increased the DeFi ranks acquiring more than $1 billion in total value locked which happened despite the warning signals in the audit reports. Harvest Finance is a Defi yield aggregator that is similar to yEarn finance and Rari Capital and these aggregators implement investment strategies on the projects to gain maximum yields. Harvest also comes with FARM governance tokens which receive cashflow from the platform’s revenue. This revenue is set at 30% of the profit.

Highlighted by the independent Defi researcher Chris Blec, Harvest finance has the one admin key for making changes to the smart contract and the owner of this key can easily perform a variety of changes and can even orchestrate a rug pull. The FARM governance community is powerless in the current arrangement and Defi projects like yEarn, Serums, and Sushiswap all have entrusted their multi-sig keys to Defi and crypto community leaders. Harvest finance developers however refused to spend time cashing out the DeFi influencers around to approve the transactions.

The TVL of the aggregator dipped a little after Chris Blec’s revelation but the lucrative returns of over 200% on the tokens and the communications on Twitter managed to keep most users from fleeing the project. Defi investor Tetranode who invested 1% in Harvest, requested that the project includes a 12-hour lock dashboard. Users will be able to exit their positions in the lock-in period if the developers introduce more changes. Autism Capital which another prominent DeFi influencer was quite impressed with the timely response:

are you happy with their response though? still not clear whether the timelock is truly effective in keeping the devs from pulling the rug.

— fractals r beautiful (@fractalsXBT) October 24, 2020

Investment in projects like these requires due diligence and the understanding of smart contracts that run the apps. Prominent influencers signaled their approval which should by no means suffice as a reason to invest in the project. The price of FARM was moving between $80 and $300.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post