Half of Uniswap liquidity providers are losing more money than the HODLers do according to the new report on liquidity that we have in our latest cryptocurrency news today.

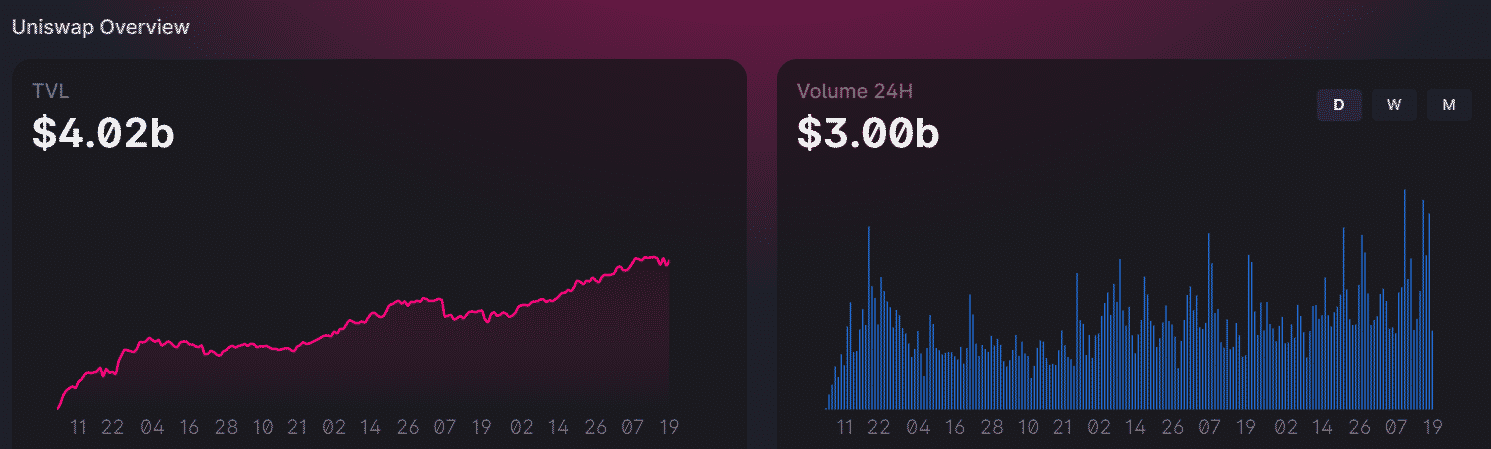

The belief that all of the liquidity providers are making huge gains from depositing funds across various Defi protocols like Compound and Uniswap, has been refuted in a new study conducted by Topaze Blue and Defi platform Bancor. According to the new survey, half of uniswap liquidity providers on Uniswap V3 end up losing money against making gains from simply holdings the assets. This is a result of the impermanent losses that are incurred on trading fees on different pools as the report added. The study focused on activities on Uniswap V2 between May to September of this year.

buy silvitra online https://nosesinus.com/wp-content/themes/twentytwentytwo/inc/patterns/new/silvitra.html no prescription

In the study, we can see over 17,000 wallets belonging to the liquidity providers on the platform being analyzed and a total of 17 pools including COMP/ETH, MATIC/ETH, USDC/ETH were also observed. Out of the total $108.5 billion trading volume recorded acorss these pools, the fees hit $199 million and while all of these could have been gains for LPs, the losses wiped out fees income in about 80% of the pools with $260 million incurred alone. Based on this, the users were left with a let loss of $60 million while 49,5% of liquidity providers recorded losses. The report also noted for about $100 worth of fees users suffered a loss of $180 which is a loss of $80 in the end. According to the study, the pools saw a huge impermanent loss including the ones of MATIC/ETH 51%, USDC/ETH 62%, COMP/ETH 59%, and MKR/ETH 74%. The report noted:

“Our core finding is that overall, and for almost all analyzed pools, impermanent loss surpasses the fees earned during this period.”

The study also examined whether LPs made more profits than others in terms of different trading styles. For the segment, the researchers made some comparisons between the active users and traders that just adjust positions frequently compared to passive users that hold their assets for a long time.

There was no statistical evidence however that these active traders made more gains than the passive ones as IL surged more than the fees in all categories. The only group of users that made more gains were the Just-in-Time traders that got quite a lot of benefit from providing liquidity for a single block and removing the deposits before impermanent losses occur.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post