Grayscale lays the groundwork for other crypto trusts with many trusts for Basic Attention Token, Tezos, Chainlink and Decentraland registering in Delaware. In today’s cryptocurrency news, we are reading more about it.

The world’s biggest digital asset manager, Grayscale Investments looks like it is preparing for possible launches of new single-asset trusts for plenty of other cryptocurrencies and it seems like Grayscale lays the ground for them. Trusts for five digital assets were filed with the Delaware corporation registry includes the ones for Chainlink, BAT, Tezos, and Decentraland. The filings were not made by Grayscale itself but the Delaware Trust company that is listed as the statutory trustee for the US State in the documentation of the company.

Grayscale is now looking for other opportunities to start offering products that meet the investors’ demands. The company will make reservation filings occasionally though a filing that does not mean that they will bring the products to the market. Grayscale will continue announcing when the new products are made available to the investors. As such, the filings could offer a new hint of which the crypto trusts will be launched. Another registration for the Filecoin trust was also made on October 15, 2020. The New York-based Grayscale is actually owned by Digital Currency Group.

As recently reported, Grayscale dissolves its XRP Trust from the Grayscale Digital Large Cap Fund the previous week because of the US SEC lawsuit against Ripple. The lawsuit accused ripple and its co-founder Chris Larsen and CEO Brad Garlinghouse of raising over $1.3 billion by selling XRP as an unregistered digital securities offering. Right after the lawsuit, about 27 exchanges have dropped support for XRP and some even delisted it.

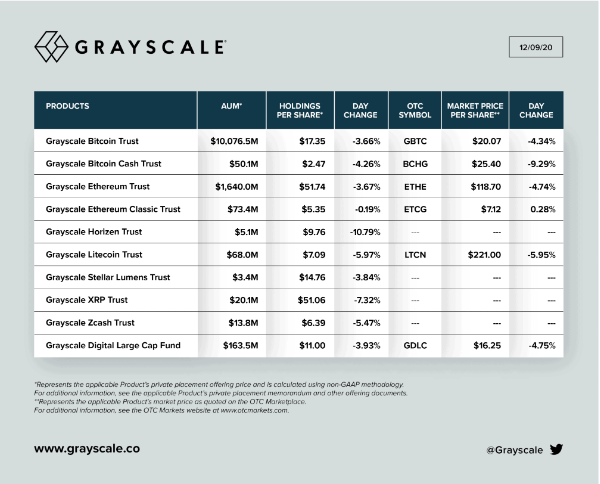

As reported recently, Grayscale finished 2020 with a huge XRP purchase and had its AUM grew by 10x in one year. The crypto fund manager made its biggest XRP purchase of more than 12 million coins. The leading digital asset manager took full advantage of the developments in the crypto space with record-breaking inflows. The company’s asset under management increased by ten times in 2020 to above $20 billion and Grayscale finished 2020 with a large XRP purchase. Founded back in 2013, the fund manager is among the biggest institutional investors to get exposed to BTC and other crypto assets without worrying about storing the assets.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post