The FTX token surges 105% over the past 30 days as the exchange surpassed both Deribit and Bitmex’s open interest but is there even more room for upsides? Let’s find out in our altcoin news today.

FTX is a crypto derivatives exchange backed by Alameda Research which is a quantitative trading company and also a crypto liquidity provider. The exchange was launched in 2019 and offered the usual spot trading, futures contracts, inverse swaps which cannot be found on other platforms. By 2020, the exchange launched its daily and weekly binary BTC options markets. The FTX token is issued on the Ethereum blockchain and the stakers are granted a trading fee discount based on the tiered system and other benefits as well like the bonus votes in the polls and the rise in airdrop rewards.

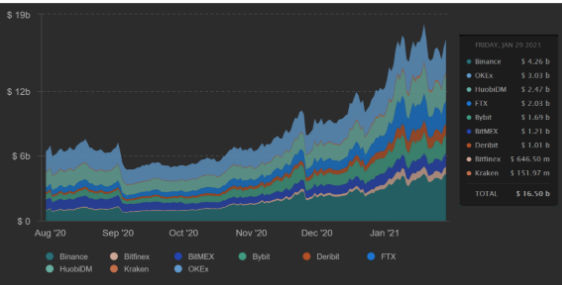

The first airdrop happened in August 2020 when 500 million SRM tokens were distributed to the token holders. To differentiate itself from the competitors, the users’ collateral was shared in one universal stablecoin wallet. This means that the traders were able to reduce their margin requirements while other leveraged tokens mimicked the leveraged ETF stocks and got listed including 3x long Bitcoin and 3x short litecoin. Leveraged tokens are derived from the platform’s perpetual swap contracts and operate as tradeable ERC-20 tokens. These products made the FTX a popular exchange among investors especially because of its rising futures contracts open interest. This figure grew by 340% over the past six months and surpassed the $2 billion mark to outperform other exchanges.

The exchange ventured into tokenized equity trading so it is now available for US citizens. In December last year, FTX innovated again by launching pre-IPO futures contracts for AirBNB and Coinbase which allowed traders to speculate what price these companies will enter into the stock market. FTX’s price doubled since the start of 2021 and to further incentivize the token holding, FTX repurchased and burned 33% of the fees generated from the exchange and 10% of the exchange’s insurance funds as well. this process will continue until half of the initial 350 million supply is destroyed.

This number represents a 45% discount to the BNB projected 2031 market cap as per the data from Messari. This also lines with the exchange’s aggregate open interest of $4.26 billion to $2.0 billion difference. Binance has an undisclosed investment in FTX and could create fewer incentives for direct competition.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post