The FED reports unbanked Americans are increasingly turning to crypto ad 12% of them bought or used crypto in 2021 so let’s read more about the report in today’s latest cryptocurrency news.

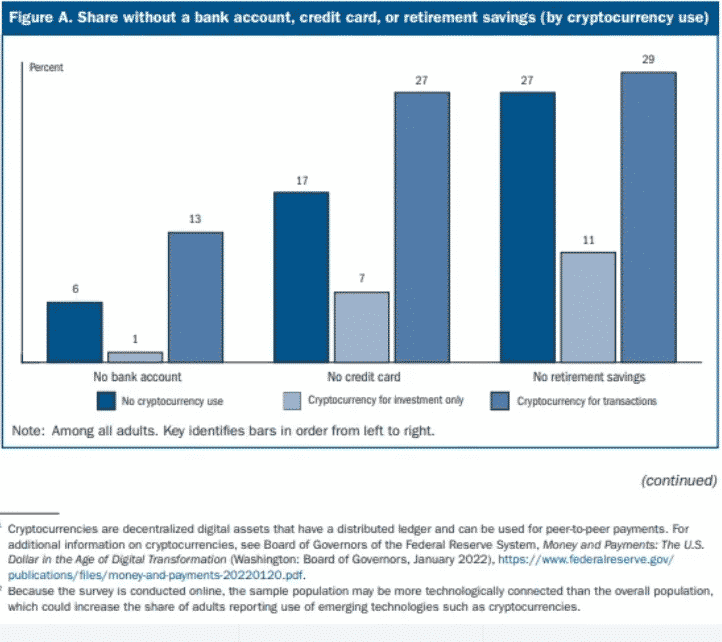

The people that transact with cryptos were twice as likely to be unbanked as people that didn’t want to use them at all according to a new survey from the Federal Reserve. The FED reports unbanked Americans are using crypto increasingly for payments and 13% of them don’t have bank accounts or up by 6% among the people that don’t’ use crypto at all. in the meantime, 27% of people using crypto for payments reported that they don’t own a credit card, and 17% of the people even don’t want or hold crypto.

This is the first time the US regulator posed a question about crypto to its 11,000-person survey panel in November and October. The FED conducted its annual survey and gauged the financial well-being of the American people since 2013. on the whole, the FED survey estimated that 12% of Americans held or used crypto like Bitcoin or Ethereum in 2021. Earlier this month, the comments made by the Federal Reserve’s Open Market Committee sent markets both traditional and crypto into a free fall with the regulator announcing that it would raise the interest rates half a percentage point.

The new survey found that people that use crypto for payments are far less likely to have retirement savings but the rate of retirement savings was the same among people that didn’t use crypto or 27% of people who use it only use it as an investment. It also remarked that people that use cryptos like Bitcoin and Ethereum tend to be wealthy:

“Those who held cryptocurrency purely for investment purposes were disproportionately high-income, almost always had a traditional banking relationship, and typically had other retirement savings.”

The survey found that 46% of crypto investors had incomes of about $100,000 while people with less than $50,000 made up 29% of the investors.

As recently reported, The former president of the Federal Reserve Bank in NY Bill Dudley believes that in order to be effective, the Federal Reserve will have to inflict some losses on the stock and bond investors that it has so far. The FED’s tools to push the stock down are focused on increasing the interest rates and enhancing financial conditions.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post