After spiking at the end of July, Ethereum’s Ampleforth suffered a huge correction. Since its previous highs, the price of the coin dropped around 70 percent and its market cap collapsed by more than 50% as we are reading more in our Ampleforth altcoin news.

The drop was triggered by the loss of capital inflows into Ampleforth as some of the other Defi projects such as Yearn.finance and Tendies, took over the spotlight. AMPL is bouncing back after its drop and it rallied by over 30 percent in the past 24 hours according to the data. The strong bounce in the multi-million dollar asset can be broken down to one thing which is the launch of the latest decentralized finance hype, Yam Finance-YAM.

YAMs = Ponzinomics of AMPL + Chad launch of YFI + Meme math of Tendies

— Ryan Watkins (@RyanWatkins_) August 12, 2020

The Ethereum ecosystem was blessed with yet another amazing project, YAM finance which was created by five developers as the protocol is trying to meld the best that the DeFi world has to offer including the fair distribution of tokens, on-chain governance and the elastic price supply of the coin. The core of Yam Finance is YAM, an ETH-based token that can be obtained if you purchase it on Uniswap or other decentralized exchanges, add yCRV or aggregate stablecoin issued by Curve to a specific pool and add one or a few of the following tokens to stake and earn YAM such as Maker, LEND, SYX, COMP, LINK, and YFI.

To obtain the ETH-AMPL token, the Uniswap Pool Share will only help you if you deposit an equal amount of ETH and AMPL in Uniswap. Ethereum’s Ampleforth is surging because there’s an influx of demand for the cryptocurrency as the investors are looking to maximize their YAM returns by obtaining pool shares and then deposit them into Yam Finance. AMPL is not the only token that is affected by the YAM craze.

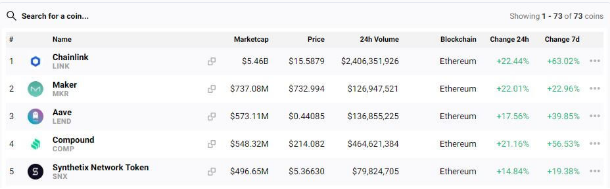

AAve’e LEND, Synthetix Network Token, Maker, Chainlink, and Compound have all seen rallies in the past day after the launch of Yam Finance. All of these tokens gained at least 20 percent with LEND and LINK establishing a new all-time high due to the protocol. It’s also important to know that despite pulling in hundreds of millions worth of value, Yam is unaudited.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post