Ethereum killers SOL, AVAX and Terra all crashed in January and lost about one-third of their value at the start of the new year so let’s read further in our latest altcoin news today.

Ethereum killers are blockchain networks that use smart contracts to enable DEFI, NFTs, and other applications and it turned out that SOL, AVAX, and Terra all crashed during the January market crash. January has been quite brutal for BTC with the price dropping 20% since the start of the month but as bad as it was for BTC, things were much worse for other coins in the top 15 by market cap especially for the so-called Ethereum killers.

Solana lost 42% of value relative to the US dollars, Terra crashed by 40% and Avalanche dropped by 36%. Algorand is worth 43% less than it was when the year started, Cardano dropped by 20% while DOT managed to lose 27% which is the same percentage as Ethereum did. These coins are blockchains that aim to replace Ethereum or they are decentralized networks that host applications and use smart contracts to automate the functions but are faster and less expensive to use.

buy acyclovir online www.mobleymd.com/wp-content/languages/new/acyclovir.html no prescription

With Ethereum-based innovations like DEFI, NFT, and blockchain-based games becoming in vogue in the past 18 months, there an increasing competition for the users. Since the new networks can’t match ETH’s traction with the users they can compete with their technology and most of the proof of stake models and the upshot is that transactions are finalized quicker and much cheaper than they would be on Ethereum which struggled with network congestion.

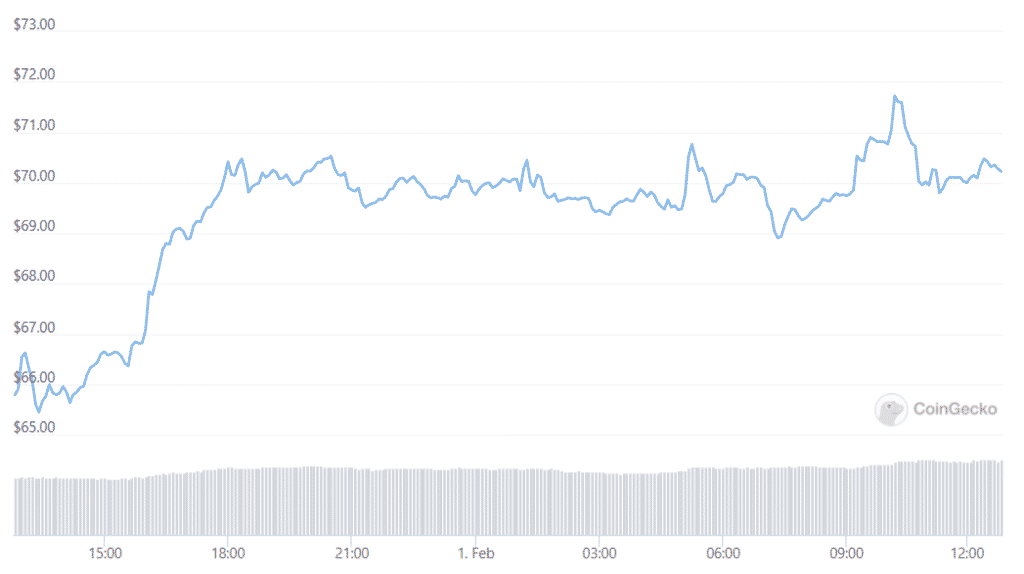

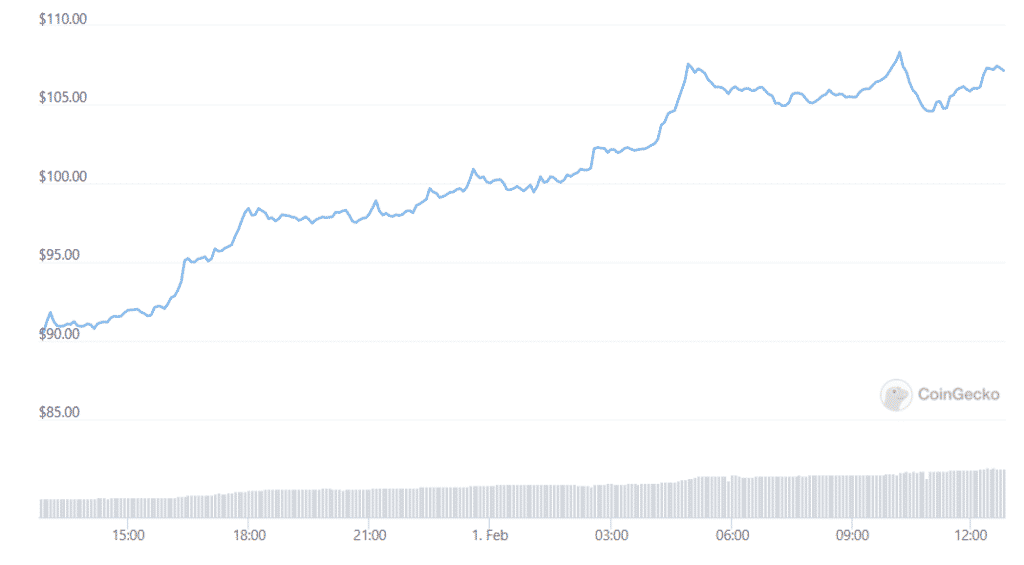

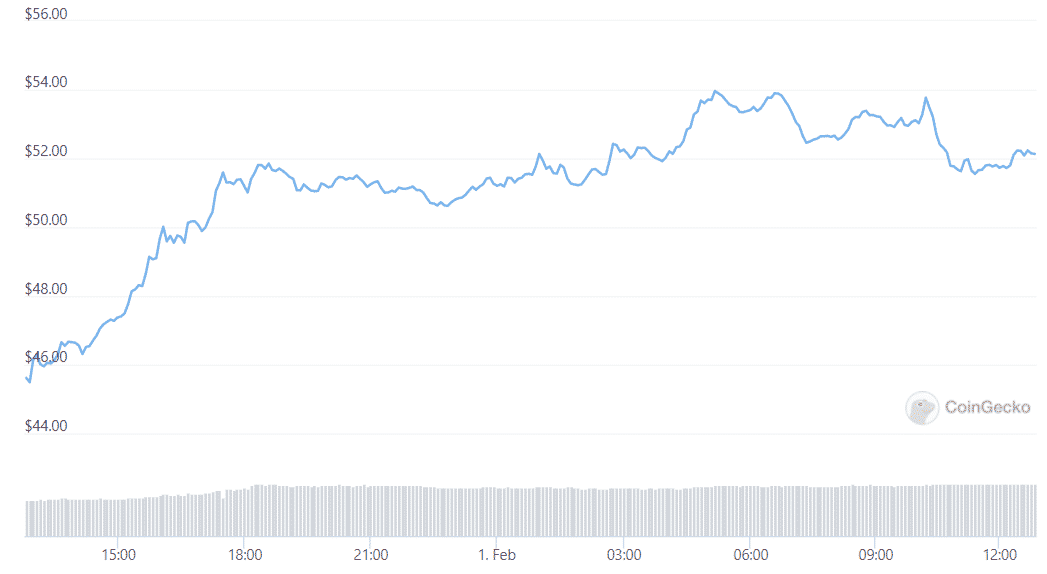

Solana ended 2020 with $26 million in a daily trading volume and a price tag of $1.84 according to the data from CoinMarketCap but then it closed out 2021 with a $1 billion in volume and a price of $178. during the same time frame, the amount of SOL tied up in the network’s DEFI protocols like exchanges derivatives markets and staking services increased to 65 million coins. Avalanche got momentum in the second half of 2021 with the price rising ten times from $11.13 to $114 by the end of 2021. Terra charted a similar path and moved from $5.73 to $91. a good portion of the gains was erased and Solana is back below $100 and Terra is now hovering near $51 while Avalanche sits between $70.

Despite most of the crypto attention remains focused on the price movement of BTC thanks to the dominance on the market that it kept losses to just under 20% after a decent finish to the week and though that’s still the worst since 2018. However, markets are showing some signs of recovery from the crash but also the investor’s demand is up for Bitcoin.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post