ETH rival Avalanche continues to rise in value as we saw it over the past 24 hours it increased by 10% while most of the other assets are in the red. Avalanche is still gaining and it is up by 44% since a week ago so let’s read more in our latest altcoin news.

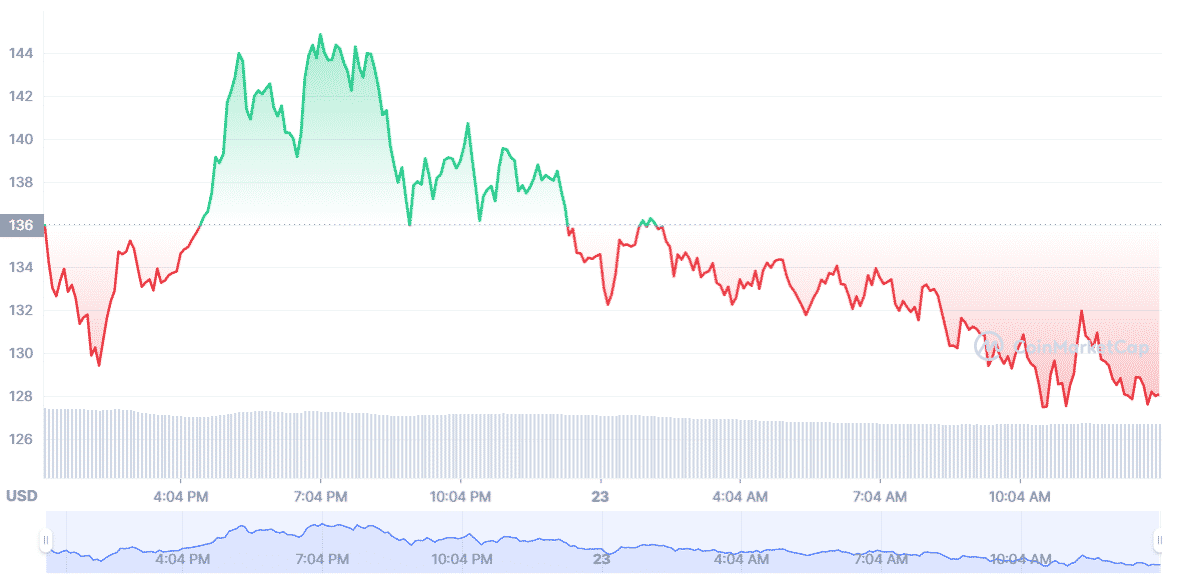

ETH rival Avalanche continued to rise in value after entering the top 10 biggest crypto assets by market value and the native cryptocurrency of the low-cost blockchain spiked by 10% as per the CoinGecko data. The crypto asset hit a daily high of $142.34 and it then corrected so it is now trading around $138. in the past week alone, it was up by 44.3% while most of the other altcoins were down and its market cap stands at over $30 billion. Avalanche is designed to provide a network where the Defi products can be built similarly to Ethereum. Defi products are experimental apps that provide automated financial services without an intermediary.

Building on Ethereum as the network behind the second biggest cryptocurrency can be quite expensive and slow when the activity on the network increases. Ethereum can process about 30 transactions per second and it often happens for the transaction fees on the network to reach hundreds of dollars. However, this is not the case with Avalanche as it can process up to 4500 transactions per second. The fees on the network can be lower than a dollar while bigger transactions can be more costly. Ethereum developers are now working towards a long-awaited ETH 2.0 upgrade which aims to make the network faster and less expensive so it has to be more competitive with the third generation blockchains which Avalanche is.

Investors are getting more interested in Avalanche which could be a part of the reason why this cryptocurrency is surging in value while ETH and BTC are seeing some strong sell-offs. Zhu Su, the CEO of Singaporean crypto hedge fund Three Arrows Capital said that he left Ethereum despite supporting it in the past and now said is an avid AVAX investor. Su called the behavior of the ETH community “gross” and said that the users were “livid” at how expensive this blockchain had become. The price of AVAX shot up since he made these comments. Avalanche tries to make Defi transactions cost a fraction of what ETH charges and Ethereum also takes a long time, like hours, while its miners prioritize to process more expensive transactions.

Yes I have abandoned Ethereum despite supporting it in the past.

Yes Ethereum has abandoned its users despite supporting them in the past.

The idea of sitting around jerking off watching the burn and concocting purity tests, while zero newcomers can afford the chain, is gross.

— Zhu Su 🔺 (@zhusu) November 21, 2021

Looking at Avalanche’s recent increase, it looks like the investors and Defi users are making much use of the blockchain’s benefits.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post