A top ECB official says that the digital euro could soon become a legal tender in the entire EU region as the ECB will start investigating how to make this possible in the next 24 months. So, let’s find out more about this in our cryptocurrency news today.

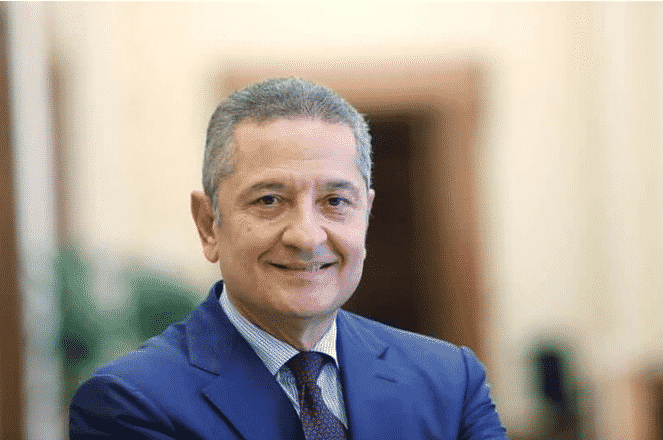

Fabio Panetta, a top ECB official says that the institution will examine how it can make the digital euro a legal tender in the region. Panetta revealed that the digital version of the euro could become a legal tender in the EU Zone. The Italian economist and ECB member hinted about this initaitive in a panel discussion in Helsinki and asserted that if the European Central Bank goes on with its efforts of launching a digital currency, the new form of money will have a chance to become a legal tender inside the borders of the EU.

Panetta added that the authorities will go thoroughly to examine this endeavor in the next two years but the ECB member also opined that achieving this move could not be taken for granted and that the new financial institution has to be cautious. Last week, he opposed the argument that this project will be redundant amid other alternative currencies as the ECB will try to make its CBDC cost-effective and guarantee its usability. The latter is vital and can provide a more widespread adoption among the general population with the Italian economist adding that the central bank digital currency will have to be attractive to capture the attention of the society.

Elvira Nabiullina as the head of the Bank of Russia agreed with Panetta about how this central bank’s digital currency will look like.

buy clomiphene online https://www.illustrateddailynews.com/wp-content/themes/twentytwentytwo/parts/new/clomiphene.html no prescription

She opined that CBDCs working under government control will represent the future of the financial network and became a fierce critic of the private digital assets which are extremely volatile and the investors could even lose huge sums of money if they deal with them. The European Central Bank outlined the plans to launch the investigation phase of the digital euro project which will go on for the next two years. In the testing period, the ECB research department will try to address key issues about the design and distribution with the digital version of the EURO will have to be able to meet the needs of the people in the region.

The CBDC should prevent illicit activities and avoid the impact on financial stability and monetary policy as Christine Lagarde who is the President of the European Central Bank said. The ECB also promised that the digital euro’s energy consumption will be negligible compared to the one of Bitcoin. It’s worth mentioning that the CBDCs and BTC are two vastly different assets.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post