Despite massive drops in price for Sushi, the Ethereum DEX SushiSwap announced a new, extensive update. When the exchange was unveiled two months ago, it caused a huge stir in the ETH and Defi space so let’s read more in today’s cryptocurrency news.

The exchange was branded as “Community-owned” iteration of Uniswap but at that time it didn’t have its own coin like UNI. The key feature was that 0.05 percent of each trade’s value will be distributed to holders of SushiSwap’s native token SUSHI. The coin will be farmed similar to the Yam Finance token which makes it a huge hit among the DeFi users.

1) Time for an update everyone!

Release of our newest UI ✨

Limit Orders 🛑

Bug bounty 🍣

Nansen Analysis 👀

Keep3r integration 🤝

Bentobox 🍱

& more夕食の準備ができました!! pic.twitter.com/KU5bCIKn8r

— SushiChef (@SushiSwap) October 31, 2020

Since its launch, however, Sushiswap underwent a strong decline. From its all-time high price of about $11.50, SUSHI crashed by 95% to $0.60 as of the time of writing. The platform’s liquidity and volume underwent a decline as well. this is mainly because of the controversies where the anonymous member of the developer’s team “Chef Nomi” took about $14 million worth of coins and SUSHI from the developer funds saying that they were his. While this is accurate technically, He said that he will not take the funds in the past. While this was resolved, the developer returned the funds and the protocol was hit with a huge blow.

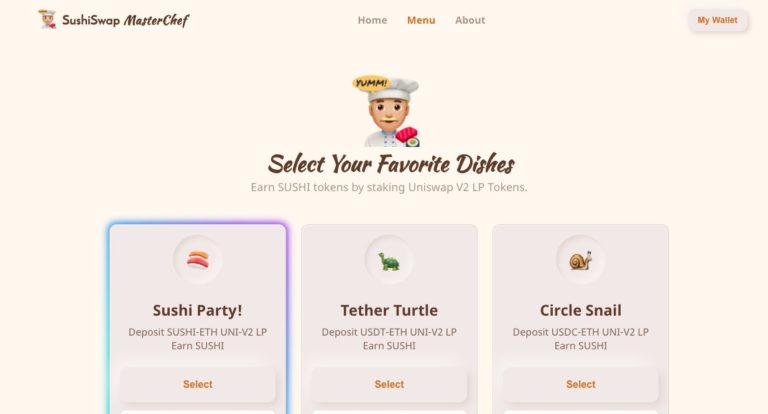

With this as a backdrop, most wondered what is next for the Uniswap fork. Apparently, despite massive drops in price, the DEX-decentralized exchange launched a new update. SushiSwap rolled out an extensive update after being quite on the front of the new features for a few weeks. The main part of the upgrade is the new user interface which is focused on allowing the users to easily interact with the protocol and all other related staking features. other key features being implemented include BentoBox and limit orders which will allow the users to supply and borrow assets in the SushiSwap system in a similar manner to Compound or Aave.

While SushiSwap is trying to put the situation with Chef Nomi in the past, the fact remains that most of the users see this debacle and SUSHI as what triggered the ongoing correction in the Defi space. One analyst even stated:

“I think @QwQiao summed it up perfectly $SUSHI was the DCB. Feels like Feb 2018, could be another exit scam pump a la May 2018. But that’s just hopium IMO. Writing is on the wall. DeFi mini bubble started in May lasted 4-5 months, about as norm as you can get for crypto.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post