DeFi trades pushed UST stablecoin to the $10 billion market cap level as we can see today in our latest altcoin news today.

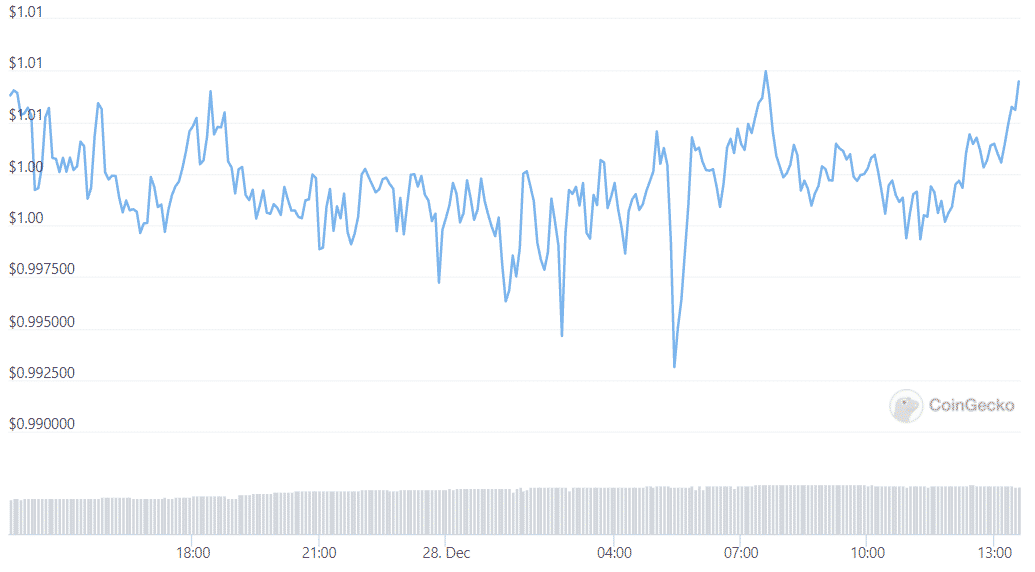

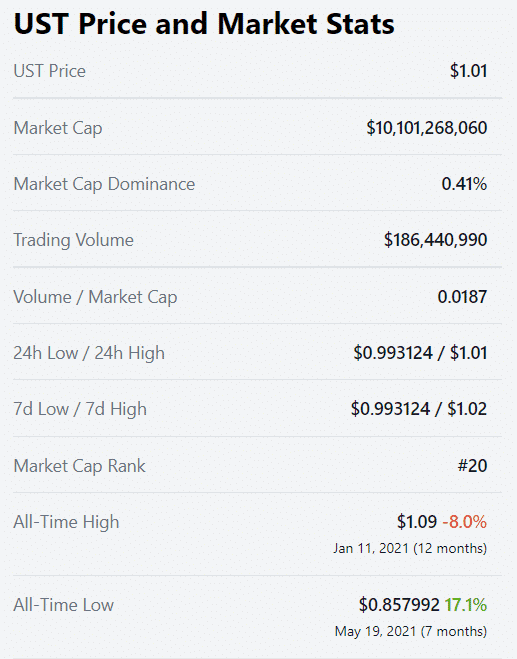

The UST stablecoin surpassed Binance Smart Chain in total value locked amid the fast DeFi growth as the Defi trades pushed the token to the new market cap high. The Terra blockchain’s growing stablecoin UST surpassed the rival DAI to become the biggest decentralized stablecoins which attained another milestone or a market cap of $10 billion. According to CoinGecko, the UST market cap pushed past $10 billion, and at the start of 2021, the market cap was below $200 million. UST even overtook rival MakerDao’s DAI stablecoin whose market cap stands near $9.4 billion while DAI has been live since 2017.

The fast-growing in the UST ecosystem came as the Terra blockchain became a huge player in the decentralized finance sector where the stablecoins play a huge role in staking, liquidity management, and yield-generating. Terra’s UST token was one of the top performers among the digital assets this year that jumped 15-fold in price with a market cap of $34 billion as per the data site Messari. Terra overtook Binance Smart Chain for the second place in total value locked which is a metric used to compare the DeFi activity that occurred on various blockchains or for other individual projects.

According to data provider Defi Llama, Terra has $17.9 billion in locked versus the $17.3 billion for Binance Smart Chain. The Ethereum blockchain remained in the first place with more than $162 billion in Defi’s total value locked. The most popular Defi project in the terra ecosystem is Anchor as a lending protocol with $9 billion in TVL accounting for half of all Defi activity on the Terra system. The popular trade involves users depositing UST into the Anchor protocol where the tokens are pooled and then lent out to the interest-paying borrowers. The accrued interest is distributed pro-rata to the depositors that expect to earn the annual percentage yield of 20%. according to the data from Tokeninsights, more than $3 billion of all UST were deposited into Anchor.

As recently reported, UNA is the native token of the decentralized payments network Terra, which reached $100 on Friday to lead the new “Santa Rally “on the crypto markets. Traders took advantage after Thursday’s drop to 10% which led LUNA to $85 and increase back again during the Asian hours to $96. the announcement by the crypto exchange Binance that it will list UST pushed LUNA above $100 and the price met resistance at the level and got down by 5 cents at press time.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post