DeFi tokens were the biggest losers in April with the revenues dropping, despite being a historically favorable month for cryptocurrencies so let’s have a closer look at our latest altcoin news today.

April fared well for memecoins like dOGE and SHIB but the DEFI tokens were the biggest losers the same month like Aave, RUNE, and more, as the research from Kraken shows. Considering bitcoin’s 17% loss as a benchmark, the rest of the DEFI sector lost 34% on average and was followed by tokens of layer 1 or base blockchains at 33%. DEFI relies on smart contracts rather than third parties to provide financial services like trading, borrowing, or lending to the users.

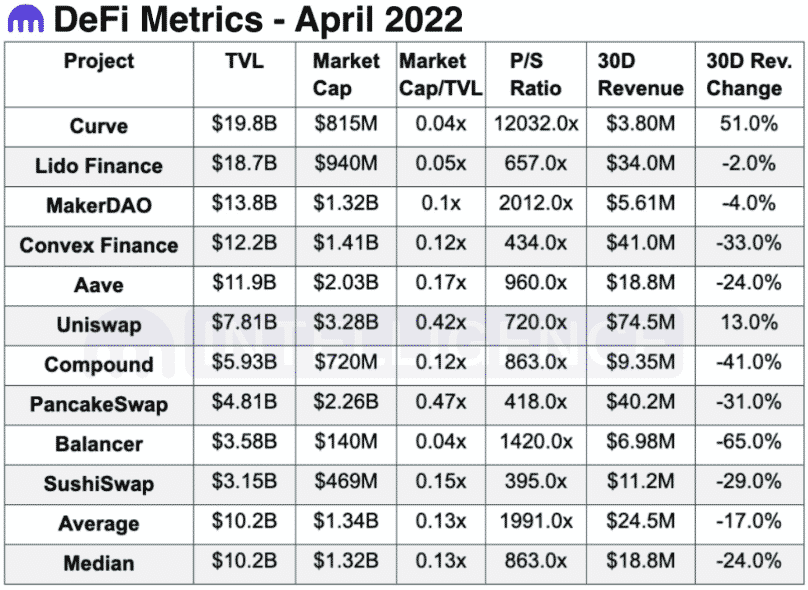

The defi tokens were the biggest losers on a yearly basis with more than 71% in average drawdowns for investors. ETH as the native token of ETH over which most DEFI protocols are built gained 3% comparatively. RUNE dropped by 51% which was the most in the sector while the minimum loss was 22%. among the layer 1 blockchains, Solana’s SOL, NEAR and Avax slumped by 30% in the past month. DeFi projects also saw drops in revenue which are earned every time a user conducts financial activity on the protocol and the protocol receives a smaller cut of volumes as fees.t eh drop occurred as the token prices dropped and interest among investors took a hit.

The financial services platform SushiSwap saw a 29% drop in revenue while the ones on DEFI exchanges Balancer dropped as much as 66% and the tokens SUSHI, and BAL all lost a lot over the past month. Curve and UNI were the only defi projects to post revenue gains as Curve earned 51% while Uniswap made 13% more. The strogn fundamentals failed to attract the buyers as CRV and UNI lost 15% and 34% in the past month. The memecoins and exchange tokens were the better outperforms among crypto sectors and memecoins lost about 19% on average. The privacy tokens outperformed with 16% in gains.

In the meantime, the trading activity in NFTs increased in April compared to the months before even as the number of users remained the same. The average daily volumes increased by 40% while the transaction number increased by the same percentage as well. CryptoPunks as the popular ETH-based NFT collection slipped to the third sport by market cap as Mutant Ape Yacht Club jumped to the second place with a $2 billion cap.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post