The DeFi tokens bleed after the Bitcoin rejection of the $14,000 level as well as the market-wide correction that started recently as we are reading some more in today’s altcoin news.

As the number cryptocurrency started the retreat from its highest price, the defi tokens bleed. Bitcoin dropped by more than 5% since its weekend high of above $14,000 but that has nothing compared to the previous losses registered elsewhere. Crypto markets are in the red this Tuesday with double-digit losses over the past 24 hours for a huge number of tokens. The price action doesn’t go in a straight line and the pullbacks are a natural part of market cycles. They are quite healthy actually as they allow re-accumulation before the next increase.

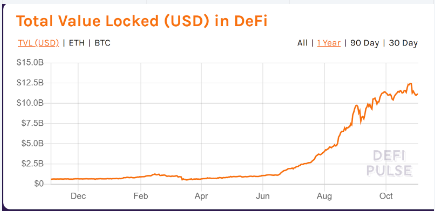

Tokens associated with decentralized finance protocols have been dropping since early September and the DeFi bubble seems to deflate. The total value locked in the sector has taken a dip as farmers pull all their liquidity in order to join the selloff. From the all-time high of $12.5 billion, TVL retreated to $11 million but is still high compared to plummeting token prices. Messari tweeted:

“DeFi blood has been shed 🩸🩸🩸 pic.twitter.com/NmWZJBihNi

— Messari (@MessariCrypto) November 3, 2020”

Double-digit losses over the past day show that some of the biggest names in defi started bleeding, including Compound, SushiSwap, Curve, Aave, Balancer, Yearn Finance, and Uniswap. The native tokens for all of the protocols crashed between 10% and 15% over the past day. Hegic is the only token that made some gains on the day with Augur’s REP still in the green as prediction markets start heating up before the elections in the United States.

Total crypto market cap dumped $15 billion since yesterday and the decline led it back below $400 billion again right as the selloff intensifies. Ethereum took a big hit with 6% lost as it drops back below $375 despite the ETH 2.0 launch nearing. Ripple dumped 4.5% back below $0.23 again, BCH, LINK, BSV, ADA, TRX, XTZ all lost about 10% on the day. There are a few gainers on the market which are trading a little over their pegs. If Bitcoin drops further below the $13,000 price range, the altcoins will likely suffer even more.

As reported recently, Crypto locked in DeFi drops seemingly for the first time in a month after the bull run as the analysis suggests, it has now ended.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post