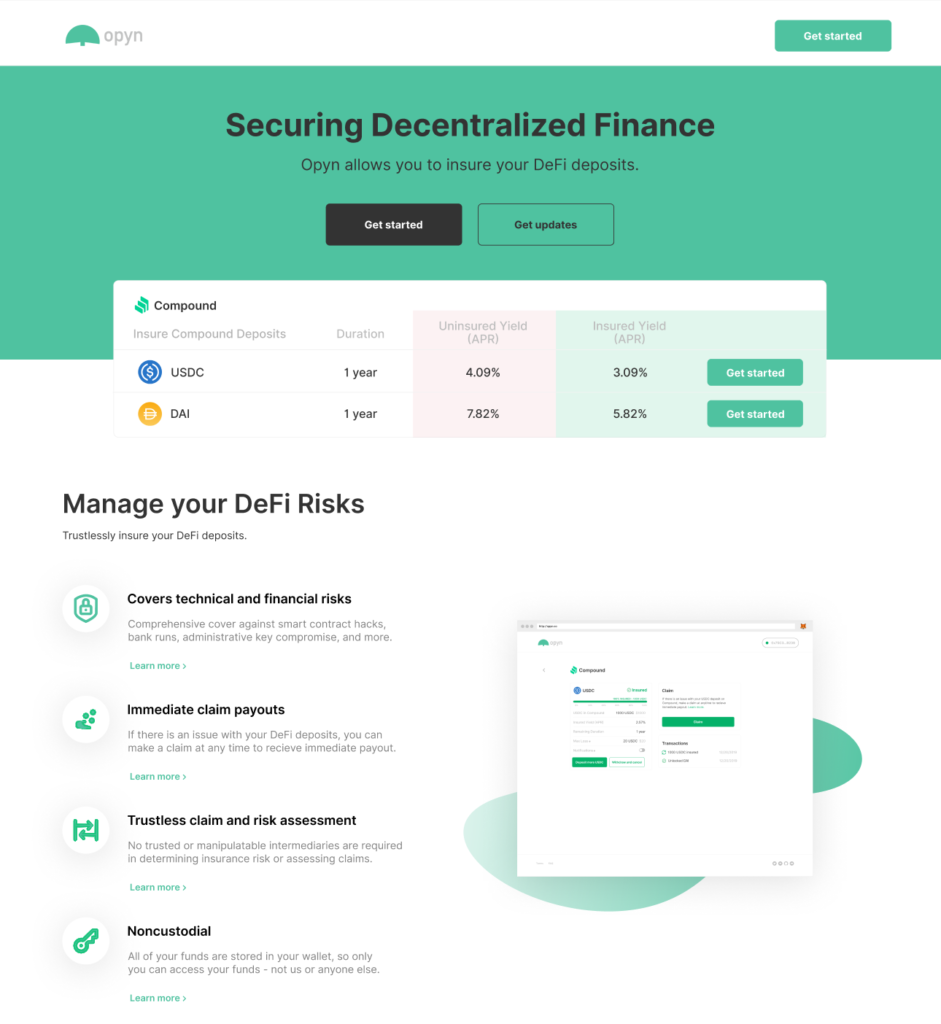

The world of decentralized finance is booming. In the latest cryptonews, we can see that the DeFi platform Opyn is ready to use put options for the buzzing altcoin named Compound (COMP). As you probably read in the news, the price of COMP skyrocketed when the coin launched last week.

Now, the decentralized options marketplace Opyn launched put options on COMP which are meant to provide a safety net of sorts by helping many holders to mitigate some of the risks in case COMP’s fortunes take a turn for worse in the next few days.

“We’re excited to launch @compoundfinance COMP put options! You can protect yourself if COMP falls to $150 or lower before July 3rd,” the company tweeted on Friday.

1/ We’re excited to launch @compoundfinance COMP put options! You can protect yourself if COMP falls to $150 or lower before July 3rd.

New ETH put is live as well! You can protect yourself if ETH falls to $230 or lower before July 10th.

— opyn (@opyn_) June 26, 2020

A couple of hours later, the Universal Market Access (UMA) also announced that they are creating the ability to synthetically short COMP on their decentralized platform. The DeFi platform Opyn closed on over $2 million in funding over the past week.

For those of you who are unfamiliar, a put option is a derivative contract which gives purchasers the right but not an obligation to sell the underlying instrument at some predetermined price on or before a specific date.

Wondering how all of this works?

A put option with a $150 strike can be bought by paying a US dollar denominated premium which is currently at $3.76. In return for this, the purchaser will receive oTokens which give everyone a right to sell COMP on or before expiry at $150. The oTokens can be bought and sold on an exchange such as Uniswap at any time before their expiry.

Basically, the DeFi platform Opyn gives a way to store COMP and benefit from it. The put option is an American-styled one, meaning that the buyer can exercise their right to sell the coin at $150 anytime before July 3. The European options, on the other hand, can be exercised only on their expiry.

When exercising this put option, the purchaser will send oTokens back to Opyn along with COMP (because oToken is the “right to sell COMP at 150”) which will give the purchaser 150 USDC in return.

Keep the entirety of your premium as well as your collateral as long as the asset stays above the strike price until expiry,” Opyn tweeted.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post