DeFi hits $2 billion for the first time ever as the yield farming craze goes on and investors are trying to remain cautious as many DeFi tokens are poised for a major downturn. In the following altcoin news today, we take a closer look at the DeFi report.

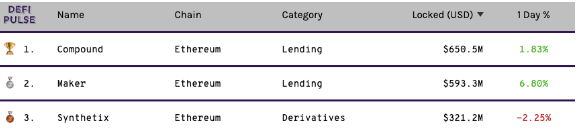

It’s been a while since the sector attained $1 billion in assets and since then, it experienced huge growth. The incentivized yield investing or yield farming as people know it, has been the main catalyst for this growth. MakerDAO was the leading DeFi platform by collateral that was held more than a year. That is until Compound launched its COMP native token that pushed itself into the leading position. Of the top ten protocols, only Flexa didn’t contribute to the yield farming. Compound, MakerDAO, and Synthetix are the top three DeFi protocols that account for the $1.57 billion in assets or 78% of the total assets of the sector.

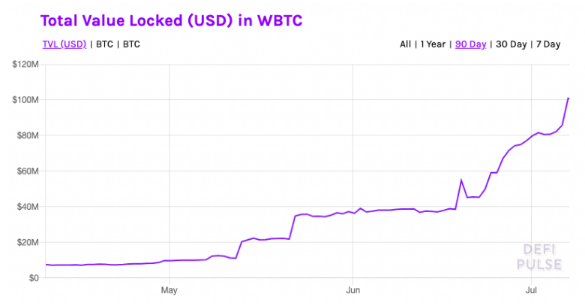

As DeFi hits $2 billion, watch out for the rise of WBTC which hit $100 million of locked BTC collateral the past seven days. Republic Protocol also crossed the $30 million thresholds since its mainnet launched back in May this year. The current craze is possibly a huge signal for a slight drop as DeFi tokens look exhausted after June. Ethereum’s native ETH could be in for a major downside as well.

Sudden bearish spikes can hit again when the metrics are getting bullish as well and there is no sign of valuation coming back to the market. This doesn’t mean that the correction is necessary but the investors will exercise caution and look at both sides before making important decisions. As per the recent reports, New Tron-based DeFi products are emerging on the decentralized finance scene according to the latest announcement by Justin Sun: Just Swap, Just BTC, and Just Lend. According to him, the Just token will serve as a native coin for the entire TRON ecosystem. As a part of the tweet, he revealed that “Just Lend” will enable Tron users to earn interest or borrow assets against the collateral.

At last, Ethereum scammers attempted impersonating top DeFi projects in order to get financial gain because the decentralized finance projects are getting more and more attention.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post