DeFi Flash loans have increased to $130 million per day as Aave’s flash loans also skyrocketed over the past few weeks due to traders taking advantage of the millions in temporary “free money” so let’s read more about the report in our crypto news today.

Aave is now issuing more than $100 million in flash loans every day as the DeFi flash loans increased from around $11 million per day at the start of the month. Flash Loans can be used in many advanced financial strategies but can also be used in high-profile DeFi hacks.

buy eriacta online www.ecladent.co.uk/wp-content/themes/twentyseventeen/inc/en/eriacta.html no prescription

DeFi is not just about yield farming and another financial tool that was rapidly on the rise as more than $138 million worth of flash loans were issued on Aave a week ago. These loans allow users to take out loans with no collateral with a condition that on-chain activity and the funds are profitable so all activity can be completed in one block.

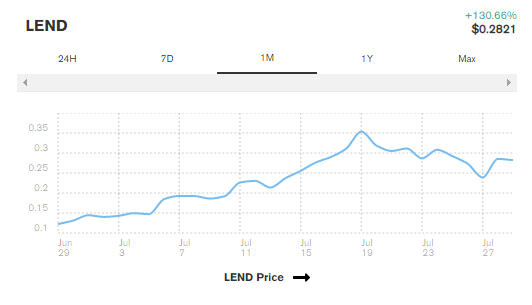

This is also another way that DeFi protocols can put locked capital to use and develop financial innovations along with the risks and rewards that come along with them. Flash loans from Aave launched at the start of the year, have been on the rise in the upcoming weeks with the total value of loans increased by more than 1000% since the beginning of July. Flash Loans allow users to write smart contracts for the execution of short-term financial actions such as arbitrage where the asset is bought for one price and sold at a higher one to a different buyer.

If the transactions submitted will not result in a profit of cannot pay back the loan amount, the string of transactions will be reversed and the loans that will result in a profit will be charged a 0.09% fee from the gains for using the Aave protocol. The vast majority of the loans are denominated in USD-pegged stablecoins with Circle’s USDC and MakerDAO’s DAI making about 95% of all-flash loans issued on July 27. Aave flash loans have increased substantially in maximum size over the course of the month as the largest loan issued reached a value of $250,000.

The biggest loan issued on July 27 was worth $9 million marking a 35-time growth in less than a month. These loans were initially introduced in 2018 by the open-source bank Marble and since then became the essential component in high-profile hacks.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post