The DeFi craze boosts Uniswap’s monthly volume to $15.3 billion which means it surpassed Coinbase, signaling that Defi is certainly here to stay so let’s read more in our latest cryptocurrency news.

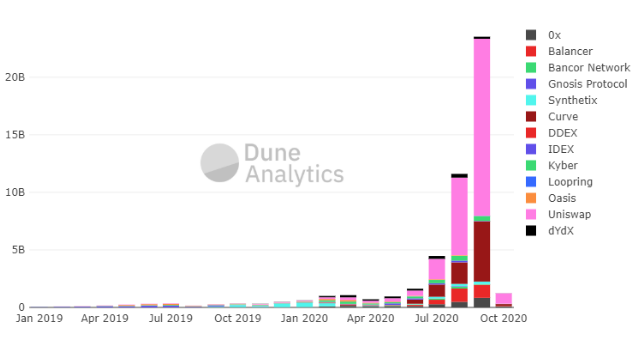

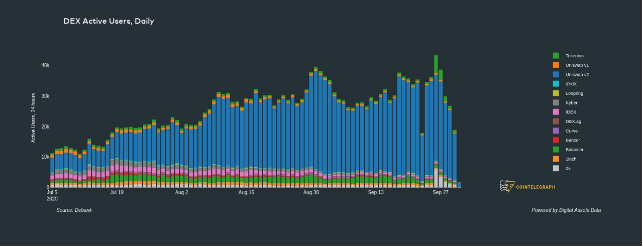

The data from Dune Analytics shows that in the month of September, the Defi craze boosts the volume of the DEX as Uniswap processed $15.371 billion in volume while Coinbase processed $13.6 billion. The major spike in the volume could be attributed to two major factors. The first one of course is the Defi craze, and the yield farming of governance tokens which caused the decentralized exchanges to thrive. The second reason could be the governance token UNI which led to a frenzy on the platform.

June marked the start of a huge DeFi craze with Compound’s COMP token starting the phenomenon. The process is quite simple as Defi users can farm new governance tokens by simply staking multiple cryptocurrencies like Ether. These decentralized finance protocols can release their governance tokens in a decentralized manner and can distribute them overtime for the users who stake. Once the users farm the tokens successfully, they can hold them until they can be sold at centralized exchanges but sometimes the tokens’ market cap gets too small.

Crypto exchanges have to consider different factors before listing these tokens. Some of the criteria include liquidity, developer activity, and track records. For the new governance tokens or Defi-related cryptocurrencies, it’s quite impossible to meet with these requirements. That’s why, Uniswap evolved into a platform to trade Defi tokens on, and has total value locked in Defi that surged which only intensified the growth of Uniswap’s volume. Uniswap first surpassed Coinbase Pro in daily volume and since then it became even more competitive with the top US Exchanges. Later in August, the Uniswap Creator Hayden Adams said:

“Wow, Uniswap 24hr trading volume is higher than Coinbase for the first time ever. Uniswap: $426M, Coinbase: $348M Hard to express with how crazy this is.”

The high volume from the exchange occurred after a slowdown in yield farming and the governance token craze. This only suggested that the uptrend in decentralized exchanges maintaining high volumes is sustainable in the long-run. Over the past few weeks, the prices of DeFi tokens dropped and the user activity in yield farming dropped but as Dune analytics said, this is not a bearish signal:

“Despite yield farming craze calming down DEX volumes crushed old records in September: $24B traded, up 100% from August. While last few weeks were down from beginning of month, all weeks in Sept were well above peak week from August.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post