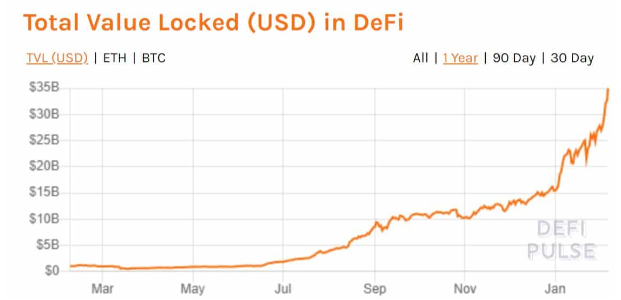

DeFi coins skyrocketed with the total value locked hits $35 billion with a few of them charting impressive gains and record prices but let’s check out some more in our latest altcoin news.

The decentralized finance field continues expanding in all directions with the total value locked in projects hit $35 billion while at the same time a few DeFi coins skyrocketed over the past 24hours including all-time highs for Chainlink and double-digit gains for Synthetix, Maker, and Aave. The total market cap hit a new high today at over $1.170 trillion while Defi coins attributed to these developments as well. For starters, LINK which is the native cryptocurrency of the oracle network registered a new all-time high of about $27 which became possible after a 9% increase on a daily basis. Furthermore, LINK increased by 120% since the start of the year when it traded at a $12 level.

Aave is the native token of the decentralized lending platform which surged by about 15% since yesterday to $520. The rebranded coin surged by 85% since Tuesday and marked a 500% higher YTD. Compound and Synthetix gained 20% on a 24-hour scale to $22 to $533 while Compound added another 116%. Maker and 0x stole the show as MKR increased by 75% in one day and 110% in a week to an all-time high of $3000. Just for a reference, MKR traded to $560 at the start of 2021. ZRX’s price skyrocketed by 130% to about $2. The asset increased by more than $225 in the past week which neared its ATH recorded in 2018.

Uniswap’s UNI token got down slightly and it recently reached a new price of $21.5. The DeFi-tracking index offered by the popular derivatives platform FTX which expanded by more than three times since the start of the year to a new high of $10,000. With the prices of DeFi tokens, the TVL in these projects hit a new record of $35 billion. Since then, it doubled since the start of 2020 and the tVL is only a good example of the growth of the DeFi sector over the past year. According to the DeFi pulse data, the TVL locked has just surpassed $1 billion on this day a year ago. The three leading projects that accounted for the majority of the TVL are the lending services like Maker with $6 billion locked, Compound with the $4 billion recorded, and Aave with $5.76 billion.

Three decentralized exchanges come next such as Uniswap, Curve Finance, and SushiSwap. It’s worth noting that the growing engagement with DeFi project causing congestion for the technology in the field. The average gas fees on the ETH network are over $22 which is a new high level.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post