A Cypher pattern forms for UNI which could set the altcoin for a 100% rally according to one analyst, associating with the DeFi term that worked in favor of many blockchain assets this year. UNI was one of them as well as we saw in the previous altcoin news reports.

The governance token which came as a result of the Uniswap platform, a decentralized crypto exchange, was doing well shortly after it was launched. It topped the charts after rising more than 5500% in a few hours of trading surging from $0.15 to $8.62. UNI remained an airdrop token which prompted beneficiaries to dump in the moment after they received it. It caused UNI/USD to drop harder from its year-to-date high as on October 7th after a few weeks of its launch, the pair was trading for $2.47 which marks a downtrend of 71.25%.

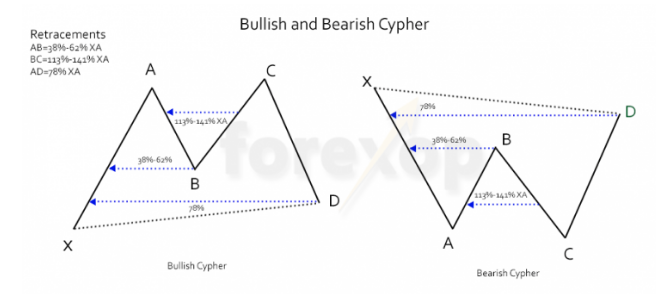

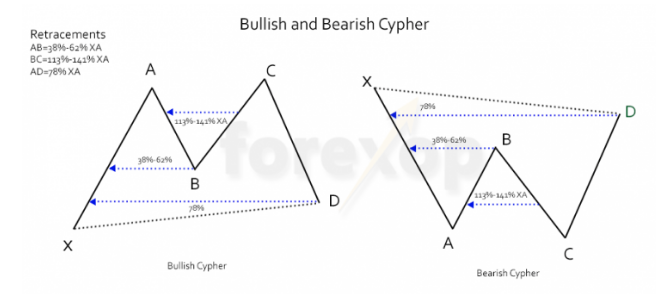

The slipover happened during a market-wide DeFi meltdown as almost every asset which represented a yield farming project dropped hard. It showed that the upside bias was exhausting which led to serious profit-taking among traders. Despite the DeFi crash, Uni was promising to recoup the losses according to an analyst who spotted that the token is nearing a Cypher pattern that could lead the coin to rise by 100%. According to ForexOP.com:

“In any Cypher, points X, C and D are the critical points. For a bullish Cypher, X should be the pattern low and C the pattern high. A bearish Cypher makes its high at X, and its low at C.”

Based on the definition, UNI is printing a bearish Cypher Pattern and it gets confirmed by retracement between AC, BC and AD against XA. Placing the Bearish cipher pattern on the UNI/USD charts makes it look like the following:

So far all fib levels line up accurately. This is the case and price breaks above $5 resistance, we’ll be seeing $7 soon.”

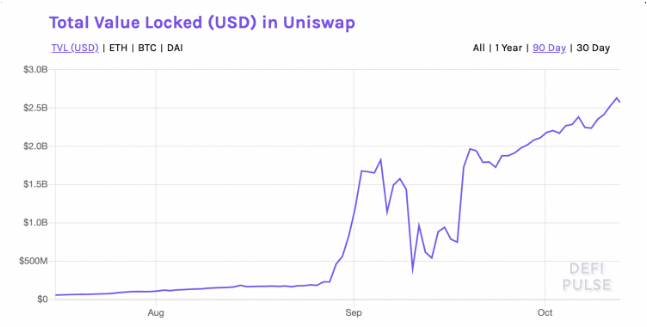

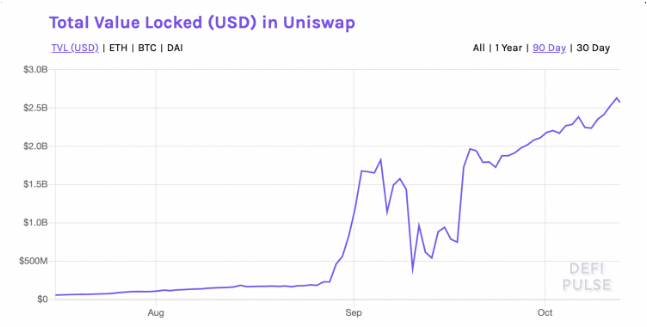

UNI is a new altcoin but it represents a three-year-old credible Defi project. The exchange facilitates hundreds of millions of dollars in volume every day but its output is even higher than the ones posted by major exchanges like Coinbase and Binance. Uniswap has paid more than $60 million to the liquidity provider and this is the same reason why UNI plunged but the total value locked inside the pool didn’t move lower when other pools lost half of their reserves.

A Cypher pattern forms for UNI which could set the altcoin for a 100% rally according to one analyst, associating with the DeFi term that worked in favor of many blockchain assets this year. UNI was one of them as well as we saw in the previous altcoin news reports.

The governance token which came as a result of the Uniswap platform, a decentralized crypto exchange, was doing well shortly after it was launched. It topped the charts after rising more than 5500% in a few hours of trading surging from $0.15 to $8.62. UNI remained an airdrop token which prompted beneficiaries to dump in the moment after they received it. It caused UNI/USD to drop harder from its year-to-date high as on October 7th after a few weeks of its launch, the pair was trading for $2.47 which marks a downtrend of 71.25%.

The slipover happened during a market-wide DeFi meltdown as almost every asset which represented a yield farming project dropped hard. It showed that the upside bias was exhausting which led to serious profit-taking among traders. Despite the DeFi crash, Uni was promising to recoup the losses according to an analyst who spotted that the token is nearing a Cypher pattern that could lead the coin to rise by 100%. According to ForexOP.com:

“In any Cypher, points X, C and D are the critical points. For a bullish Cypher, X should be the pattern low and C the pattern high. A bearish Cypher makes its high at X, and its low at C.”

Based on the definition, UNI is printing a bearish Cypher Pattern and it gets confirmed by retracement between AC, BC and AD against XA. Placing the Bearish cipher pattern on the UNI/USD charts makes it look like the following:

So far all fib levels line up accurately. This is the case and price breaks above $5 resistance, we’ll be seeing $7 soon.”

UNI is a new altcoin but it represents a three-year-old credible Defi project. The exchange facilitates hundreds of millions of dollars in volume every day but its output is even higher than the ones posted by major exchanges like Coinbase and Binance. Uniswap has paid more than $60 million to the liquidity provider and this is the same reason why UNI plunged but the total value locked inside the pool didn’t move lower when other pools lost half of their reserves.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post