Curve’s vote locking feature brings the CRV rewards up by 2.5 times but as the token tanks, is this even worth it?

buy antabuse online www.ecladent.co.uk/wp-content/themes/twentyseventeen/inc/en/antabuse.html no prescription

We are about to find out in the latest altcoin news today.

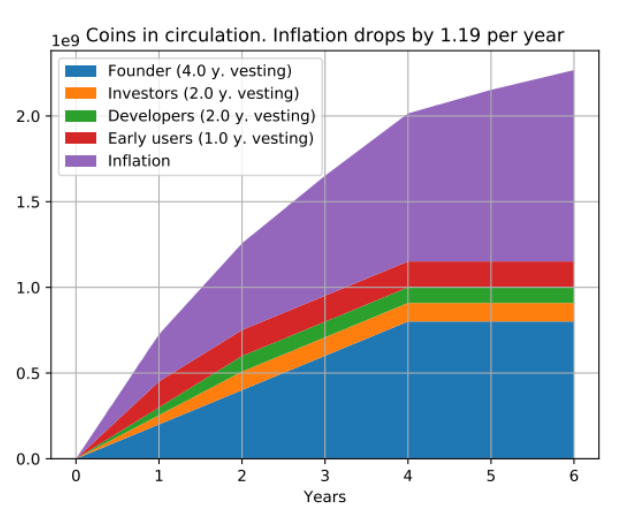

Curve just launched the native platform token CRV which is provided as a reward for the Curve Liquidity providers and in a few days, the CRV holders can vote lock their tokens to accumulate voting power and increase their rewards by up to 2.5 times. Users with more than 2500 voting power will be able to submit the voting proposals but those with less can vote still on the existing proposals.

Curve’s vote locking feature rewards the users that provide liquidity to the platform with CRV and so far the standard deal is to provide more liquidity and earn more CRV. Starting in August 28th, the CRV holders can vote to lock their tokens to increase the rate at which they will earn rewards from the pool by up to 2.5 times. Lock 1000 CRV for one year and you will get a voting power of 250 CTV and if you lock it for four years, you will get 1000 CRV.

The tokens locked in the CRV voting escrow will accrue the voting power eventually in the form of veCRV voting tokens which can be used to vote on proposals by the governance protocol, the Curve dao. Also, one user’s boost multiplier will increase alongside the voting power but there’s no direct relationship between the boost multiplier and the voting power. Other factors include the ratio of voting power to the total voting power of a pool which could affect the boost multiplier.

The speculators have to work out whether locking up the tokens for a period is worthwhile. Locking up the tokens means that they will have the opportunity to sell them at any time and the token which is still young, tanked so far according to the data from CoinMarketCap from $13.31 at the launch to $6.31 today. If the DeFi bubble pops, the train could get derailed and the smaller tokens can crash.

👀👀👀 https://t.co/OvYWEpRo8I pic.twitter.com/0VicsW2c7j

— DeFi Pulse 🍇 (@defipulse) August 15, 2020

Still, the Curve asset could appreciate some more control over vote locking. Those with higher voting power will have a bigger influence over the governance of the platforms and those with a voting weight of 2500 CRV which will be able to submit the proposals. The goal of the voting is to transition Curve from a centrally governed operation to a decentralized platform.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post