Curve’s governance model is a threat to other Defi tokens as the protocol’s governance tokens could bring huge profits but the liquidity providers don’t actively participate in the governance process which leaves decision making into the hands of the few powerful stakeholders so let’s find out more in our latest altcoin news.

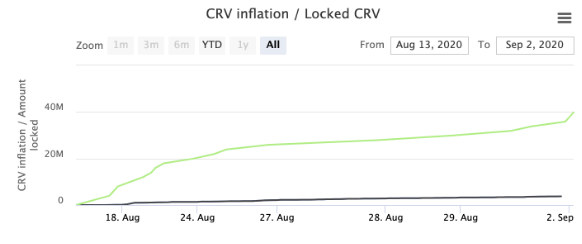

With the latest reward boosting the initiative that improved the situation, it doesn’t actually solve the fundamental governance problem. The non-financial incentives are quite important for building long-lasting decentralized communities. A few yield farming schemes over the summer have made a handful of users quite rich. When it comes time to vote on the protocol improvements with the newly earned governance tokens, farmers are quite silent.

The idea of liquidity mining assumes that the reward tokens are used to guide the evolution of Defi protocols but the obsession of the sector with profit brings a lot of challenges to the assumption. The example of CurveDAO only shows that the Curve’s governance model is a warning to other tokens in the network since the users are not willing to stick with the project after getting the short-term gains. Only a few of the larger players are left to govern the project which creates a hostile environment for power grabs.

The issue doesn’t only include Curve as its roots are within the community itself. Human nature seeks the path of least resistance so DAOs should find ways to harness greed for the benefit of their protocols as well. While the Defi platforms are growing since 2018, the popularity grows as well especially after Compound launched its governance token in June. The introduction of COMP started the yield farming movement where the users provide liquidity to help the lending function for rewards and Curve followed the same path with CRV.

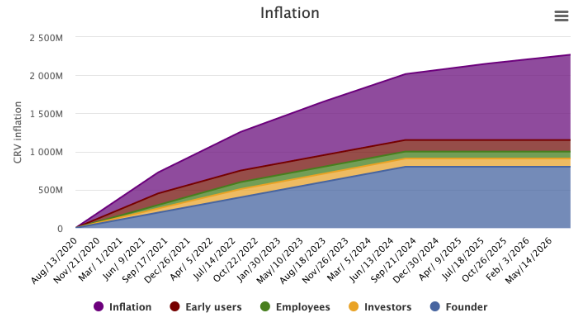

The idea of decentralizing Curve’s governance is to give the tokens to the liquidity providers via inflation:

“The circulating supply at the end of year one should be around 750m CRV. The rate of inflation is there to help put the DAO’s control in the hands of liquidity providers on the Curve Finance protocol.”

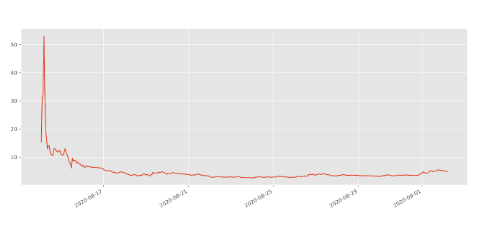

Holders of CRV have an opportunity cost once they start locking in their tokens because the tokens are tradeable. If the price goes up or down, the tokens are stuck in the protocol and can only be sold or purchased after spending the gas fees to remove them from their locked space.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post