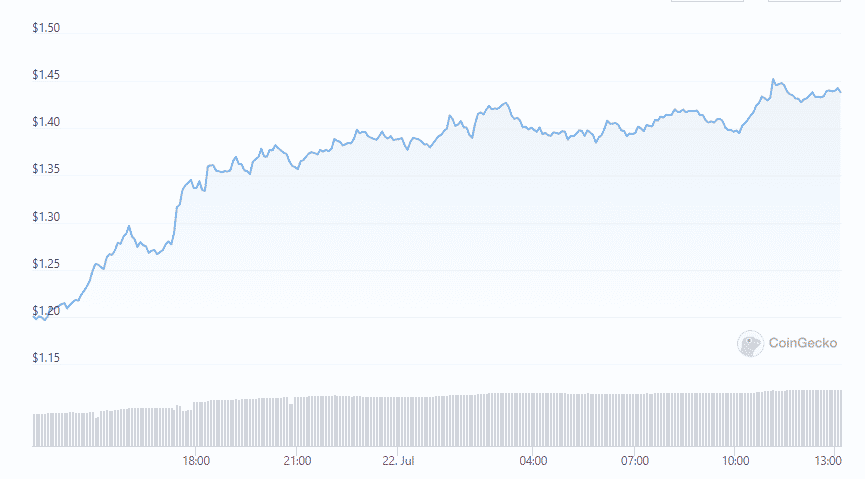

Curve DAO token surges 21% amid the latest stablecoin announcement of joining Aave in taking aim at the Maker Decentralized stablecoin with the new product so let’s have a closer look at today’s latest altcoin news.

Curve DAO token surges 21% in the past 24 hours and it is set in the 60th position with a market cap of $760 million. The main driver behind today’s price action is the upcoming launch of the Curve stablecoin which was confirmed by Michael Egorov as the founder of Curve:

“Over-collat. That’s all I can say for now.”

you know you know

curve – stablecoin incoming 👀$CRV 🚀 #stablecoinWAR pic.twitter.com/sYg13WRLYz

— 區塊先生 ⚠️ (rock #58) (@mrblocktw) July 21, 2022

Curve joined some other Defi protocols like Maker and Aave in the race to launch a decentralzied and over-collateralized stablecoin. Unlike other offerings like Tether and USDC, other over-collateralized stablecoins are backed by assets like Ethereum and Bitcoin. The process helps the stablecoin retain its dollar peg amid the crypto volatility and despite today’s surge, the Curve native governance token is still down 97.67% from the ATH of $60.50 that was recorded in 2020. A total of 75,393 wallets own CRV tokens and the total value locked on the Curve Protocol holds $6.02 billion and another $765 million stake in the protocol.

Other leading tokens in the DEFI sector like Lido, Compound, 1Inch, and Sushi also extended their bullish action. The leading crypto BTC increased 1.65% in the past 24 hours and Ethereum also posited an 8.4% gain in the same timeframe.

As recently reported, Curve Finance voted to disperse the $3 million in fees to the governance token holders after a community vote. the voting period that was looking to determine the admin fees and how they are allocated, closed in favor of the token holders. About $2,631,601.92 worth of fees accrued before the vote opened and now will head to community coffers. The protocol will continue to disburse the fees on a weekly basis after the initial payout as Curve CEO, Michael Egorov explained.

Curve Finance voted and now the recent vote will be seen as a successful exercise in a distributed governance manner where platform users will be encouraged to participate by having skin in the game. The vote passed unanimously with 95 votes cast in favor which represents 49.75% of the entire eligible voting pool. Back in August, the anonymous Defi users deployed smart contracts for the decentralized autonomous corporation with the team-building without their knowledge or consent.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post