Curve and YFI are both falling together and in our altcoin news today, we will try and find out why, according to a crypto researcher.

Curve and YFI are among the few decentralized projects that had interesting yield farming products to offer and their volumes increased upwards due to the consistent community involvement. However, the price of their governance tokens is reflecting the boom and as Anil Lulla, the co-founder of Delphi Digital which is a New York-based digital asset research company tried to provide a potential explanation behind the correlation of the two assets. in the latest analysis titled “Do Vested Rewards Work” Lulla went deeper into the token distribution model for curve and YFI.

12/ This has resulted in me interacting with the SNX community more and more.

In addition to this, seeing all the updates and features the @kaiynne + the team were consistently adding helped strengthen my belief in their ability to execute.

— Anil Lulla (@anildelphi) October 15, 2020

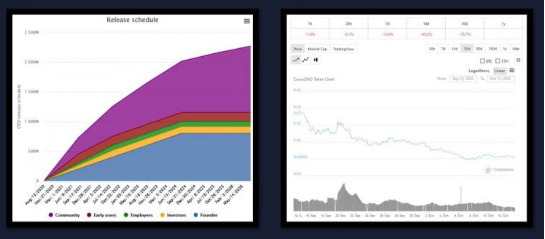

By focusing on Curve mainly and its governance coin cRV, the researcher noted that the protocol ensures “insane inflation” by releasing more than 2 million CRV every day. it does not offset, however, the supply with vesting and phenomenon which allows the project to reward the stakers that are there in the long-term. Mr. Lulla added that the absence of the vested rewards will create a downside pressure on the coin for stakers that do not feel the need to lock the token into Curve liquidity pools for a longer timeframe. They dump CRV in open markets which is a sentiment that has already brought the value down by 90 percent. The researcher discussed the massive dumping of the HEGIC token after its parent protocol of the same name decided to scrap the plans to vesting:

“Almost immediately, the community started complaining and HEGIC started dumping. Just a few hours later, HEGIC announced they’d be returning to a lock-up.”

The recent flurry of the new DeFi projects is trying to overcome the issue that Curve and YFI carried. Mr. Lulla named DODO which is a liquidity protocol that reserved a huge part of the total supply for incentive programs for the providers and traders alike. The winnings came with the lockup period of 14 days after which they vested over the next half of the year:

“Despite the lock-up, DODO got ~$100M of liquidity from 3K+ wallets.”

He explained how the Delphi Digital proposed PowerPool which is a DeFi protocol to scrap their plan of the 85% of the governance token CVP supply release after liquidity mining as Lulla said:

“Our team published a proposal where 5 percent of total supply currently circulating will only rise by an additional 7-12 percent in the next 12M via vesting. Despite the holders whose tokens are now locked up voting, the proposal passed with overwhelming support (95% of votes approved).”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post