Crypto markets lose about $100 billion and ETH is dumped to a 2018 ATH in the latest crypto market news that we are reading more about today.

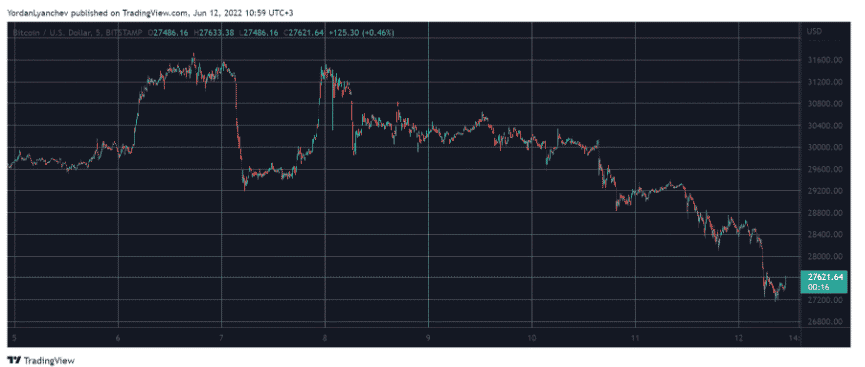

The past 24 hours brought more pain to the crypto market with BTC dumping to a low of over $27,000 but the alternative coins suffered even more. ETH, for example, crashed below $1500 to a 2018 ATH level. After a few attempts to overcome $32,000 last week, the main crypto started losing value gradually and the last rejection brought it down to $30,000 where the asset remained for a few days. The landscape changed when the US inflation numbers went to 8.6%.

The worst is yet to come as BTC started dropping more a few hours later and this culminated earlier today when the coin slumped to $27,200 which is the lowest price seen in a month. Bitcoin’s market cap is also down to $520 billion with the silver lining for the bulls being the domiannce over the altcoins is up by 48%. The crypto markets lose about $100 billion but the developments didn’t deter the traditional hedge funds as reports claim they continue pouring funds into that market.

DeVere Group’s CEO remains bullish on Bitcoin and thinks the asset will surge by the end of the year. While BTC dropped by 5-6% in the past day, most altcoins are down by double digits. Ethereum is among the biggest losers and it is down by $200 in the past day and by over $600 in a week. ETH dropped below $1500 but it also declined to a 2018 ATH of $1450. Binance Coin dropped by 12%, ADA dropped by 15%, XRP by 11%, and DOGE by 14%. Avalanche is also in the red as it dropped by 20% and TRON took the retracement with a bit less pain and a 7% drop.

The lower and mid-cap altcoins are in worse positions with the total marekt cap dumping $100 billion in a day. The metric is down by $200 billion in a few days and under $1.1 trillion now. The Bank of Canada thinks the crypto market has to be regulated before becoming big enough to cause a huge financial meltdown. Huobi went deep into DEFI and Web3 by launching a $1 billion investment.

As earlier reported, In spite of the losses, the bearish momentum prevented ETH From breaking through the $1800 level in the past week. After a sluggish pace in April, the inflation surged again in May which might have a negative influence on the crypto markets already suffering from the FED’s strict monetary policies.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post