The crypto market’s cap risks a drop below $1 trillion with the declining demand for Tether and the negative premiums for altcoins are all signs that a rough winter is ahead of us so let’s have a closer look at today’s latest crypto news.

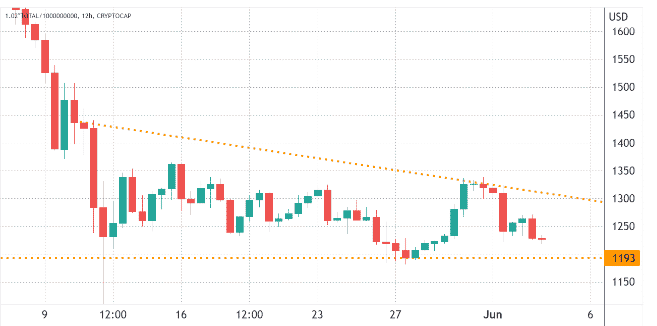

The total crypto market cap ranged from $1.19trillion to $1.36 trillion in the past month which is in the 13% range. During the same time, Bitcoin’s 3.5% and Ether’s 1.6% gains for the week were not really encouraging. To this date, the crypto market’s cap risks a drop and the total market is down 43% in two months so the investors are not likely to celebrate even if the descending triangle formation shifts to the upside. The regulation worries continued to weigh on investor sentiment as a prime example from Japan which decided to enforce new laws after the Terra USD or TerraUSD Classic collapse. Japan’s parliament also passed a bill to limit stablecoin issuing to licensed banks that are registered money transfer agents and trust companies.

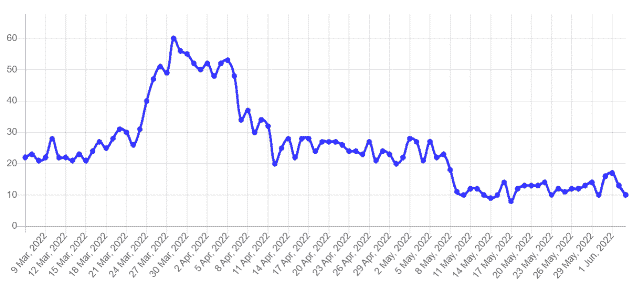

The bearish sentiment was reflected in the crypto markets as the Fear and Greed Index hit 10/100 on June 3. the indicator was below 20 since May 8 as the total crypto cap lost the $1.7 trillion level and reached the lowest level since January 27. The Crypto market’s cap could drop even further as the charts show. Waves rallied 109% after the liquidity was brought back to Vires Finance and the Neutrino Protocol USDN stablecoins got the $1.00 peg after a $1000 daily withdrawal limit was imposed.

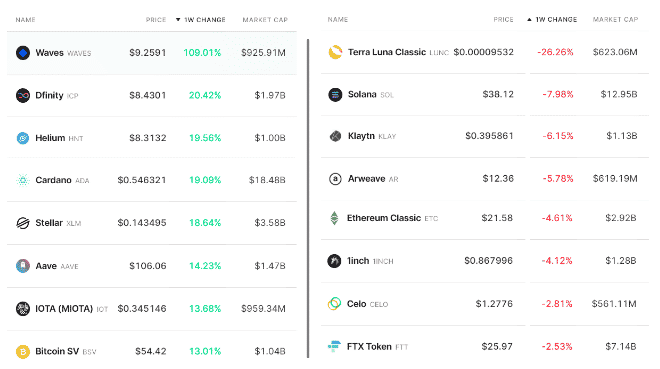

Cardano gained 19% as investors expected the Vasil hard fork to improve the scalability and the smart contract functionality which incentivizes deposits to the long-hyped decentralzied finance applications on the network. Stellar increased by 18.6% after MoneyGram partnered with the crypto platform and launched a service that allows users to send and convert stablecoins into fiat currencies. Solana lost 8% because of an unexpected block production stop on June 1 which required validators to coordinate another restart after the four-hour outage. The outage issue has impacted the network negatively on multiple occasions in the past 12 months.

The OKX Tether premium is a good gauge of China-based crypto trader demand and it measures the difference between the china-based P2P trades and the US dollar. The surge in buying demand tends to pressure the indicator above the fair value of 100% and Tether’s market offer got flooded which caused a 4% or a higher discount. Tether was trading at 2% or a higher discount but the indicator showed a modest deterioration and bottomed at a 4% discount with the data leaving no doubt that the retail traders were caught off-guard with the total crypto cap failing to break the $1.3 trillion resistance.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post