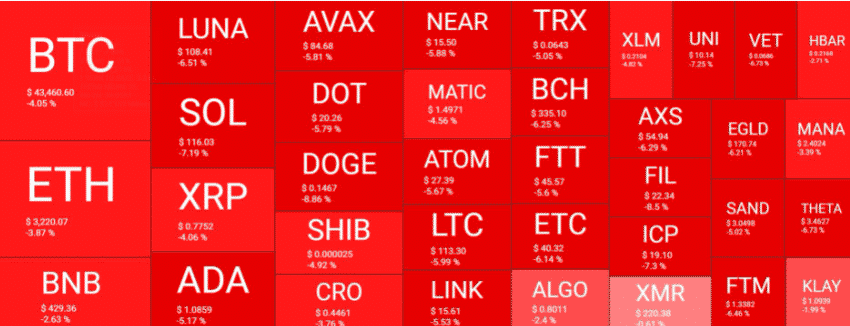

The crypto market lost $130 billion due to the interest rates fears and both BTC and ETH dropped alongside the rest of the coins that are drowning in the red so let’s read more in today’s latest cryptocurrency news.

Bitcoin dropped by 5% and Ethereum by 8% with other coins being hit harder. If you were planning to cash out on the crypto investmetns, maybe it is time to reevaluate. Crypto markets joined equities in sinking lower after the FED governor Lael Brainard reiterated the central bank’s commitment to tightening monetary policy. Among the top 15 digital assets, DOGE experienced the biggest decline in the past day and lost 15% to settle below $0.15 but it did pad the market cap this week when Elon Musk joined the Twitter board.

Solana lost over 12% of value overnight and dipped under the $116 price point for the first time in months. SHIB, DOT, and Avalanche also saw some double-digit percentage losses. The top two coins y market cap BTC and ETH shaved 5% and 8% of their price but in all the market cap was down by 6% and dropped below $2 trillion and lost $130 billion in one day. The equities are also down with NASDAQ taking the brunt of the 2% losses.

All of this came before the FED released minutes from the FED Open Market Committee’s March meeting where it raised interest rates for the first time. Brainard talked about the internal conversations during the Federal Reserve Bank conference:

“It is of paramount importance to get inflation down. Accordingly, the committee will continue tightening monetary policy methodically through a series of interest-rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting.”

Interest rate increases are designed to make borrowing costs go up and dampen spending and keep inflation in check. This has a knock-off effect for the share prices with companies having less appetite for capital investmetns or wage increases and there’s also less money floating around and sitting in the crypto accounts. The crypto market lost $130 billion since the FED’s main talking point was Russia’s war on Ukraine so in light of the invasion, the committee agreed to raise the federal funds by 25 basis points with many leaving open the possibility for aggressive 50 basis increases in the near future.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post