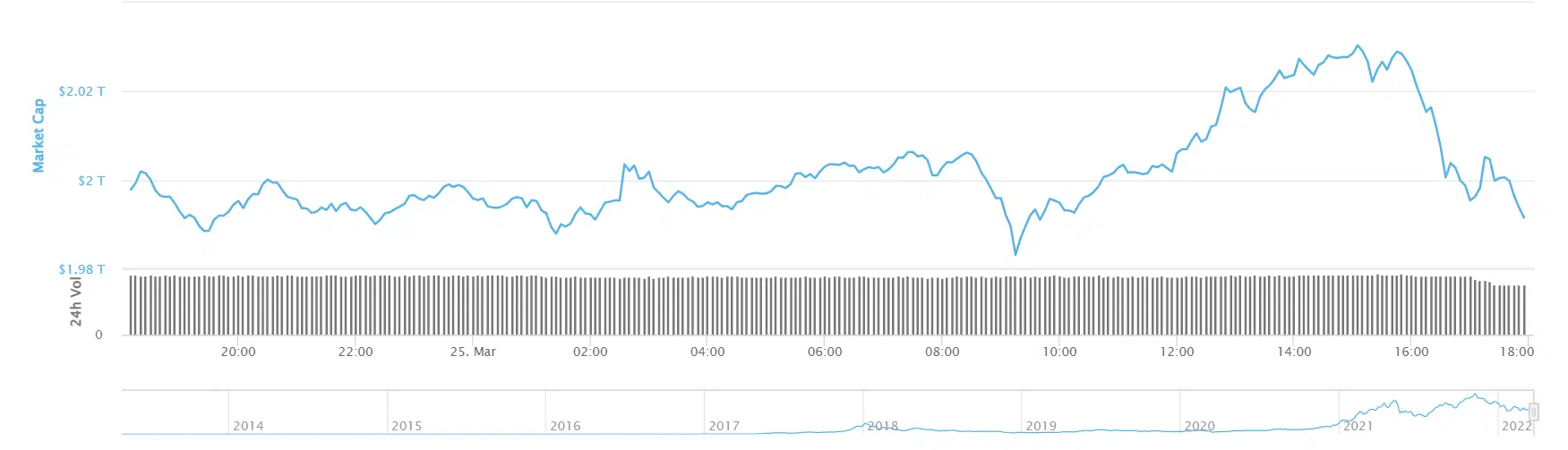

Crypto market cap rallies to $2T with institutions showing readiness to enter after Goldman Sachs revamped its website’s homepage to show support for crypto and blockchain technology as we can see more today in our latest cryptocurrency news.

Bitcoin and the rest of the market rallied on Thursday with the total value of digital assets crossing $2 trillion for the first time in three weeks amid the signs of shifts in the market sentiment that was led by Goldman Sachs. BTC printed an intraday high of $44,253 and gained 3% during this session as per the data from TradingView. The biggest crypto by market cap recovered over 33% from its January low.

buy super kamagra online http://petsionary.com/wp-content/themes/twentytwenty/inc/new/super-kamagra.html no prescription

The total market cap rallies by 7% since Monday and reached $2.1 trillion with the market cap also reaching $2 trillion on CoinMarketcap as well.

While not bullish, Bitcoin’s Fear and Greed Index escaped the extreme fear and it is now in the fear stage set at 40. the volatility and the sentiment indicator are based on a scale of 0 to 100 with the higher readings corresponding to a bullish outlook for BTC. The market’s apparent shift in sentiment came after months of downward price action for BTC and other altcoins which led some investors to speculate about the new bear market sentiment. Amid the geopolitical unrest, the members of the legacy finance community-identified crypto as the main opportunity.

Also, BlackRock CEO Larry Fink said the war in Ukraine could force the nations to reconsider their currency dependencies and can pave the way for digital assets. He also touted digital assets as a viable tool for international settlements and transactions. In the meantime, Goldman Sachs seems to have put crypto on its radar and redesigned its website’s homepage to show the support of the metaverse, crypto, and blockchain space. Goldman Sachs completed its first over-the-counter options trade with Galaxy Digital and the bank initially launched the BTC futures product for CME in June 2021. Grayscale Investments announced the launch of the new smart contract fund whcih allows accredited investors to back the Etheruem competitors and the new fund also opened for daily subscriptions with exposure to Cardano, ADA, AVAX, DOT, MATIC, and Algorand.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post