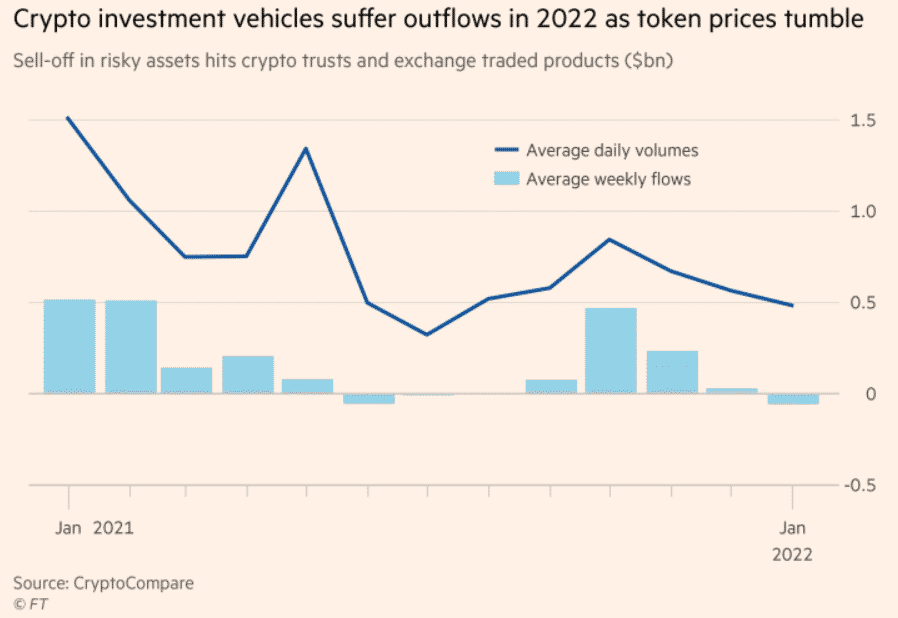

The crypto investment products see record outflows as the year started with traders pulling an average of $61MN from digital assets each week during January so let’s find out more in today’s latest altcoin news.

Crypto investment products suffered major outflows in January as the sliding token prices and the risky assets reversed the fortunes of the sector whcih frenzied interest last year. Vehicles such as the Grayscale Bitcoin Trust give investors exposure to crypto assets without holding the tokens, attracted billions in 2021 while ProShares, WisdomTree, and VanEck raced to launch products and capture a share of the market. The tide of cash slipped right into reverse for the first time since last summer after a sharp decline in the crypto prices which saw the BTC price tumble from its high of $69,000. this is when investors decide to pull in an average of $61M from digital asset vehicles each week and marked the quickest pace of withdrawals in a year according to CryptoCompare DAta.

The $25 billion Grayscale Bitcoin Trust whcih doesn’t allow withdrawals, found even more sellers than buyers for the shares and send the discount between the share price and the value of the trust’s asset to record levels of 25%. the average daily trading volumes for these products all tumbled to their lowest levels and the decline came during a month when the crypto prices recorded declines in equities especially US Tech stocks as investors unloaded assets with higher risks. Michael SonnenShien who is the Chief executive of Grayscale Investments said that the investors sold off the digital asset holdings alongside growth stocks, in anticipation of interest rate rises from the US FED:

“It’s important to note that there’s still significant investor demand for digital asset investment products, but institutions seemingly reacted to the Fed by offloading their positions.”

The increased presence of professional investors on the markets led to more alignment between tech stocks and crypto as per analysis because the institutions see both assets as risky investmetns with the higher growth potential tending to sell them at the same time, Greg Taylor at Purpose Investments noted:

“Crypto has definitely correlated more to risk assets than was expected. In the last month, it has acted more like a tech stock than anything else.”

The outflows followed a price drop which only suggests that investors are reluctant to buy the dip but Taylor did say that there were buyers on the market still with the “buy the dip” mentality still being alive and well in crypto.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post