Cover protocol suffered a minting attack which caused its price to crash 97% making it the latest DeFi project to suffer an attack as we read more in today’s altcoin news.

A suspected hacker exploited the Cover staking protocol and inflated the token supply by printing more than 40 quintillion coins. In a surprising move, the suspected attacker returned the funds with a note:

“Next time, take care of your own shit.”

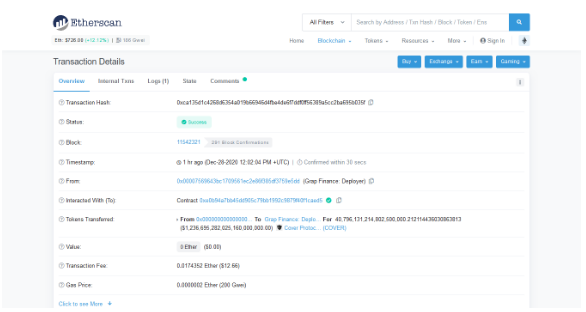

In the initial exploit, the attacker managed to liquidate over 11,700 coins on the 1inch Decentralized exchange aggregator inflating the supply of the token according to the ETH wallet explorer Nansen. The malicious actor drained more than $5 million from the project as of press time. The cover protocol suffered the attack and released a statement addressing the incident:

“The Blacksmith farming contract has been exploited to mint infinite $COVER tokens. We have restricted minting access to the farming contract in order to stop the attacker. If you are providing liquidity for $COVER token (uniswap or sushiswap) please remove it immediately.”

According to the Cover Protocol team, the issue affected the token supply with the funds held in the claim/no-claim pools are still safe. The project says that it is investigating the hack attack which caused a huge drop in the COVER token price as it failed by more than 97% while also eliciting negative comments from the cross-section of the community on social media.

buy super avana generic buy super avana online no prescription

Back in November, Cover merged with Yearn Finance.

Monday’s incident made cover the latest Defi projects to suffer a malicious exploit this year that was ridden with opportunistic chances for profiteering attacks against numerous protocols. The spate of the Defi hacks over the year stand out as one of the main disappointments in the crypto space for 2020 with the data manipulation deeming as easy to accomplish on many projects.

As previously reported, Warp Finance had recommended its users not to deposit stablecoins as they were investigating some irregularities on the platform. The protocol announced itself back in October and the platform was launched on December 9 officially, eight days ago and now, Warp Finance got hit with a flash loan attack a week after its launch. Flash loan attacks involved borrowing collateral and returning it in one single transaction after using it to manipulate the price but white-hat hacker Emiliano Bonassi reviewed the attack and thinks that it involved multiple flash swaps to three liquidity pools on the Uniswap decentralized exchange.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post