COTI will launch a first-ever decentralized market fear index for cryptocurrencies thanks to the enterprise-grade fintech company as we are reading more in our latest crypto news today.

The volatility index is used to measure the implied levels of volatility on the market and represents a counter index to traditional ones that track upward movements. It is used by investors whey are assessing the risks and quantifying fear. COTI, the enterprise-grade fintech platform took it into its hands to launch a decentralized version of the popular stock market VIX index. cVIX is the first of its kind that brings certain benefits for crypto traders.

In a press release, the cVIX index is intended to measure the implied level of the volatility on crypto markets and provide traders and investors with tools when making important entry and exit decisions. It’s also worth noting that the index will be created in a completely decentralized manner which means that it will run on its own without involvement from the outside or ownership of a legal entity. In addition, the cVIX index uses Chainlink’s architecture as well as multiple oracles to retrieve the information required.

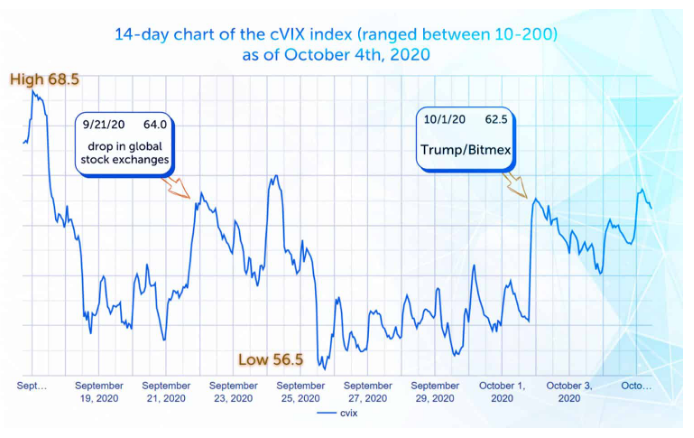

The following chart based on the 14-day time frame shows the correlation between macroeconomic shockwaves and the index as well. These events include the drop in the global stock exchange that happened on September 21 with the BitMEX CFTC fiasco as well as the news about Trump being positive to the Coronavirus. In addition to the index, COTI will introduce a self-adjusting and decentralized trading system which allows for a permissionless means of entering long and short positions that are based on the cVIX index.

Basically, the traders who rely on volatility can insure themselves against the market stagnation while the traders that take long positions on the index can profit in the events of higher volatility. cVIX will support deposits and trades in ETH and USD but the platform is expected to grow bigger and more get more support for additional cryptocurrencies faster in the near future. It’s also expected to migrate to COTI’s proprietary consensus algorithm Trustchain and it will also start on Ethereum.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post