The Celsius bankruptcy filing shows there was a .

buy medications online https://gaetzpharmacy.com/medications/ no prescription

2 billion hole in the Balance sheets and also shows that the platform made certain poor asset deployment decisions when the paltform grew faster than it anticipated so let’s read more today in our latest cryptocurrency news.

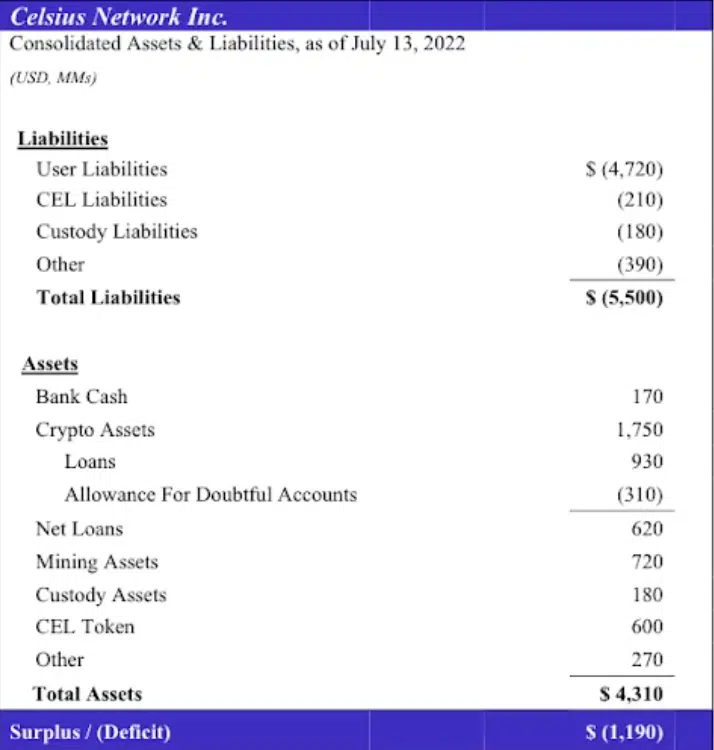

The Celsius bankruptcy filing confirms the liabilities outweigh the assets by $1.2 billion and shows the company owes its creditors and clients over $5.5 billion. The assets after paying off three large loans from Maker, Aave, and Compound in the past week allowed it to reclaim $1 billion worth of collateral which totaled $4.3 billion. That means that Celsius is $1.2 billion short and insolvent so it’s what remains of the $2 billion hole that is keeping Sam Bankman Fried from wanting to do a deal with the company.

Without $1 billion in reclaimed collateral, the debts outstripped the assets by $2 billion at the time when Bankman Fried was rumored to have met with Celsius and BlockFi. Celsius froze the user funds on June 12 after its CEO sent a tweet claiming that not even one person had issues with withdrawing money from the paltform. After the freeze, Celsius put out two more statements on the website explaining that it needs more time to stabilize.

Starting last week, the company paid off three of its loans over the course of a few days. Among the assets on the Celsius balance sheet when the bankruptcy was filed which include $600 million worth of the native CEL token. The token’s price dropped to as low as $0.42 on the news of the bankruptcy filing but then rebounded to $0.71. the filign also listed Symbolic Capital Partners as the biggest secured creditor and said that it has 2000 ETH worth about $23 million at the time of filing.

As for the unsecured credits, the biggest balance is owed to Pharos USD Fund which is a Cayman Islands fund with an $81 million claim. Further down the list, there’s Alameda Research to which Celsius owes $13 million. In a section explaining how Celsius came to be bankrupt, it wrote in the filign that the number of assets on the platforms grew faster than expected:

“As a result, the Company made what, in hindsight, proved to be certain poor asset deployment decisions. Some of these deployment activities took time to unwind, and left the Company with disproportional liabilities when measured against the unprecedented market declines”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post