The CEL token makes a recovery despite Celsius filing for bankruptcy and now it is witnessing a mid-crisis bounce so let’s have a closer look at today’s latest altcoin news.

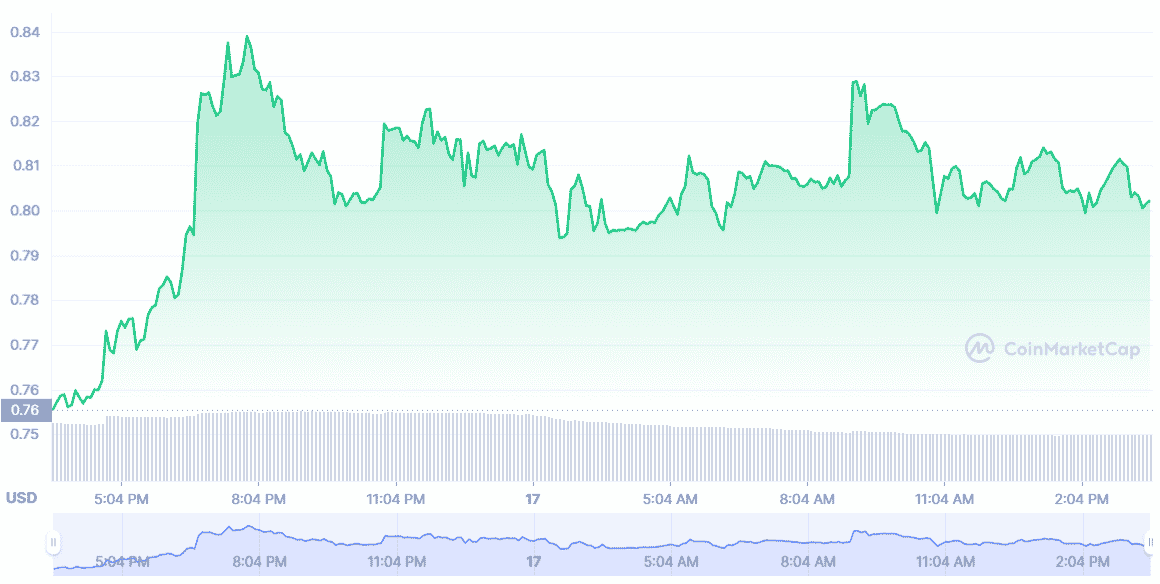

The token’s value transcended pressure and increased by 25% over the weekend after registering for bankruptcy protection. Despite the management’s efforts, the Celsius Network token shows signs of a revival as the past 24 hours saw the price of CEL increasing by 80%. The CEL token makes a recovery and was trading at $0.73 which is a 30% rise over the July 15 closing price. Faced with some strogn skepticism, CEL’s price surged from $0.63 to $1.53. Celsius filed for Chapter 11 bankruptcy in the US Bankruptcy Court for the Southern District of New York. The company halted withdrawals, transfers, and swaps on the platform due to extreme market volatility.

buy tadacip generic buy tadacip online no prescription

The crypto market cap was trading at $928 billion or up by 3% in the past 24 hours so the total trading volume of all cryptos increased by 3%. The withdrawal suspension by the Celsius Network pushed the crypto market into a gloomy pit and the bankruptcy position revealed $1.2 billion in faulty agreements. This includes the liquidation of $840 million in Tether’s debt and $750 million worth of mining hardware as well as the loss of 38,000 ETH. In addition, it has $441 million in loans to retail customers that were secured by digital assets valued at $765 million.

The price rally of CEL seems to be typical with the token witnessing slower climbs and dips over the past 30 days. The CEL token peaked at $1.53 per token before reversing course. In the meantime, since Celsius started repaying the financial obligations, the on-chain analysis of CEL showed some strong accumulation and outside of the established exchanges, the CEL token quantity increased by 0.5%. Celsius’s volume was also increasing and the CEL volume was 18 million during the early hours of July 15. The same volume stood at 66 million but the variation in volume only shows fluctuating investor sentiment.

The price of Celsius’s CEL crypto is increasing due to short-sellers unloading the CEL tokens with exchanges like FTX, Okex, and Huobi still experiencing short positions of 80%.

As earlier reported, The Celsius bankruptcy filing confirms the liabilities outweigh the assets by $1.2 billion and shows the company owes its creditors and clients over $5.5 billion. The assets after paying off three large loans from Maker, Aave, and Compound in the past week allowed it to reclaim $1 billion worth of collateral which totaled $4.3 billion

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post