PancakeSwap’s CAKE aims to slice a piece of the Uniswap dominance cake after it emerged as one of the top DeFi platforms and its Binance Smart Chain integration made it a liquidity magnet against competitors as we can see more in our altcoin news today.

The decentralized finance took a back seat to nonfungible tokens in the past month but this still hasn’t stopped some of the major DeFi projects from developing a plan on how to grow their ecosystems and the market share. Another project that outperformed the field lately is PancakeSwap or CAKE, a Binance-smart Chain automated market maker that allows users to exchange tokens to earn a portion of fees through yield farming.

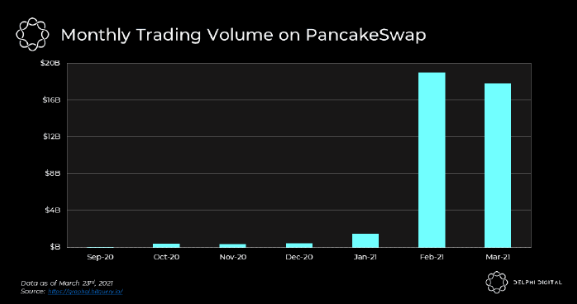

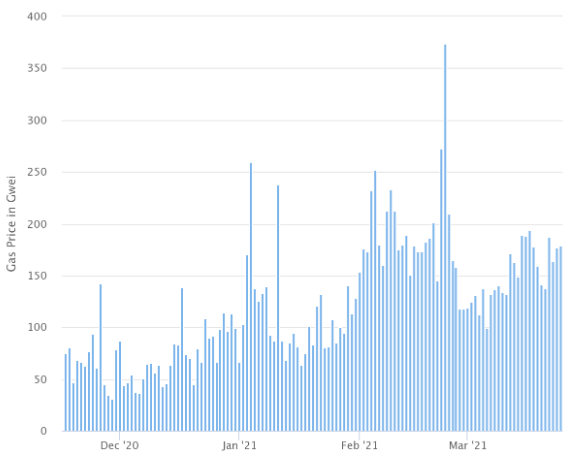

According to reports from Delphi Digital, there are a few factors that play a major role in helping the ecosystem grow in recent months and analysts predict that the protocol continues to be a major competitor to Uniswap. Anyone who tried to transact on the ETH network in 2021 noticed the astronomical rise in the gas fees compounded by Ether’s rising price. If you look at the average gas fees chart on ETH with the chart detailing the trading volume on PancakeSwap, a correlation can be seen between higher fees and even more activity on the platform.

CAKE aims to now take a piece of the Uniswap dominance cake as it is a “vast network effect” from being the “biggest crypto exchange that’s the first choice for retail traders.” The prospective users can gain access to the BSC by simply withdrawing their tokens from Binance to one BSC-supported wallet. Delphi Digital also outlined CAKE’s token economics as a major factor for future growth. Unlike UNI and SUSHI, there’s not a hard cap on the CAKE tokens supply which gives the platform the chance to perpetually conduct targeted vampire attacks to attract more liquidity and to incentivize projects to launch on PancakeSwap’s AMM.

According to Delphi Digital, PancakeSwap is aware of how the numbers look and the team announced a vote to change the emission schedule with the chance to leave it the same. The data from Tradingview shows that since hitting a low of $8.30 when the price of the token made a few attempts to break out a new ATH and trading at $15.63.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post