BTC rejects at $45K and marked a three-week high but then failed to sustain it, while ATOM increased by 5% and became the biggest gainer from the larger-cap altcoins as we can see in today’s latest altcoin news.

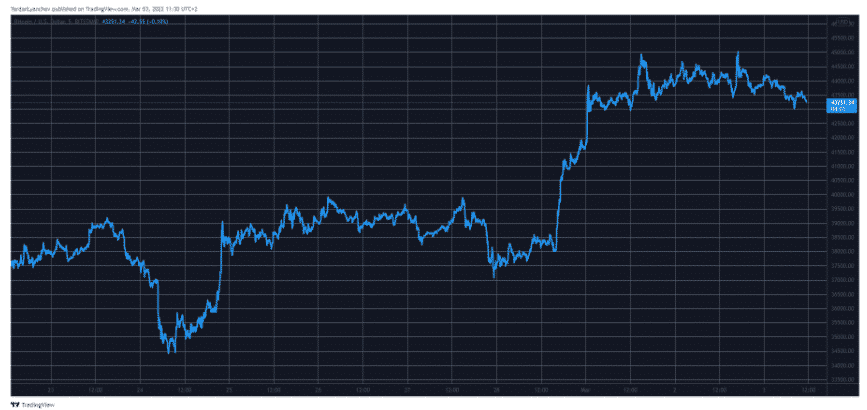

Following a few days of charting more gains, BTC rejects at $45K and slipped by $2000 with most altcoins retracing today but cosmos was among the few that surpassed these expectations. After last week’s roller coaster that happened when Russia attacked Ukraine, BTC started to regain value and hit ,000 but while it was stopped there at first, the asset broke down and kept on increasing towards new highs.

buy symbicort online https://www.evercareop.com/wp-content/themes/twentytwentyone/inc/new/symbicort.html no prescription

This resulted in hitting $45,000 just as March started but in fact, BtC touched that level twice in the past two days but then failed to breach it successfully. The latest rejection came a day ago when BTC expected the level and marked a three-week high but the bears stepped in and pushed it south by $2000. It tried to reclaim some ground in the next few hours but it stands just a few dollars above the intraday bottom as of now. Being increased by 20% per week means that the asset’s market cap is well above $800 billion.

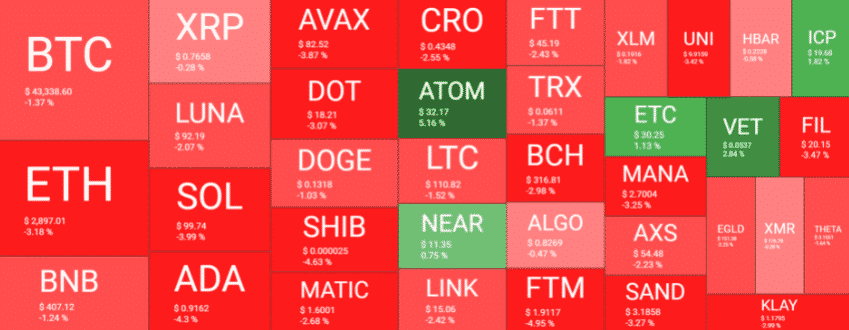

The alternative coins went through a similar price drop after Russia’s invasion of Ukraine started and most market highs yesterday but then retraced slightly. Ethereum surpassed $3000 for a moment but then failed to maintain this level and dropped by around 3% to $2900. LUNA, ADA, Ripple, BNB, Avax, DOT, DOGE, SHIB, and CRO are also in the red. Cosmos is among the exceptions because ATOM increased it is up by more than 5% in one day and stands above the $30 price point. The biggest gainers are OKB and Anchor protocol which soared by 25% and OKB by 10%. the market cap is down by $30 billion but it still remains over $1.9 trillion.

As recently reported, The price surge in Terra’s LUNA token over the past week made it the second biggest staked asset among the major cryptocurrencies in terms of total value staked and LUNA ever surpassed ether which has over $28 billion in staked value. The data from Staking Rewards shows over $30 billion worth of LUNA which is not staked directly on various protocols which represent most of the token’s $34 billion market cap. The participants are earning more than 6.98% in annual yields and some 41% of the eligible tokens are staked as the data shows.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post