BTC fights to remain at $35,000 while SOL dropped by 19% after suffering another network outage as we are reading more in our latest Bitcoin latest news.

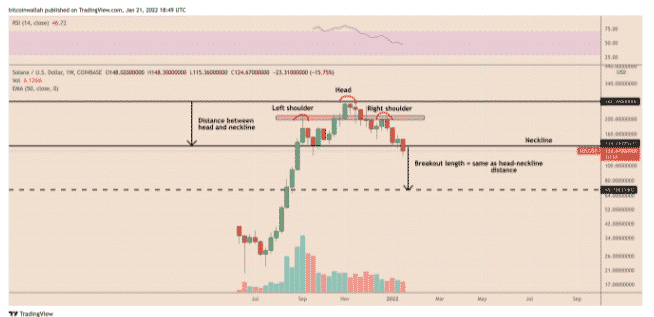

After signaling brief signs of revival on the crypto market, the situation seems quite gloomy today again. BTC fights to remain at $35,000 while most other altcoins are in a worse shape including Solana which dropped by 19% after suffering another network outage. Bitcoin traded above $43,000 a week ago before the whole landscape changed and all bears stepped up the next day, the crypto dropped by $5000 to a six-month low of $38,000. While this was already a huge correction, the asset headed south and Bitcoin dumped to the lowest point since late July 2021 at $34,000.

It lost $10,000 in a few days but on Sunday we saw some optimism as BTC reclaimed some ground and surpassed $36,000 at one point but then it turned out to be a false breakout. Since then, BTC lost $3000 and now stands below $35,000 so the market cap is just over $650 billion. The alternative coins suffered lately with some short recovery attempts but now the red has taken over once again. Ethereum stood above $3300 before the market wide-correction drove the market to $1000 and ETH managed to bounce off to $2500 but another 8% decline drove it to below $2400.

More daily losses were evident from Binance Coin that dropped by 8%, Ripple by 6%, Cardano by 12%, and Terra by 10%. Solana is among the worst performers amid network issues reported from the users and the blockchain protocol itself and SOL dumped by 20% and now sits at $85 which is the lowest price level since August. More losses came from the NEAR protocol that dropped by 20%, Theta Network by 16%, Oasis Network by 16%, and Quant dropped by 16% as well. The crypto market declined by $100 billion in one day to under $1.7 trillion.

Bitcoin reentered a key price zone that signaled the start of an end of the bear phases. Charles Edwards who is the founder of crypto investment firm Capriole flagged the BTC network value to transaction ratiometric as it delivered a new oversold signal. Bitcoin’s price losses accelerated over the weekend with the market not being far off the retest of a seminal $30,000 mark before Monday’s Wall street open. For the on-chain analyst, there are a lot of reasons to believe the extent of losses seen is more of a market overreaction rather than a simple tase of things to come.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post