BTC and the crypto market depreciate as the US dollar value increases and imposes a negative impact on crypto prices so let’s read more in our latest cryptocurrency news.

Big cap cryptocurrencies such as Ethereum and bitcoin reported major losses and the ETH liquidity and whale activity hit yearly lows. The improving US dollar is helping the economy but it’s seemingly hindering Bitcoin’s appeal. The BTC and crypto markets saw the second day of losses after the weekend of breaking records. The global market cap is down by 3.4% according to Nomics and it is hovering near the $1.75 trillion marks.

📉 #Ethereum $ETH Number of Addresses Holding 100+ Coins just reached a 19-month low of 45,518

Previous 19-month low of 45,546 was observed on 21 March 2021

View metric:https://t.co/FbjiMG3uFX pic.twitter.com/T8J8xlPX8o

— glassnode alerts (@glassnodealerts) March 23, 2021

The cryptocurrency market caps were responsible for most of the losses as BTC got down by 4.5% at the time of writing and struggled to stay above the $54K. Ethereum faired worse and dropped by more than 5% which has probably something to do with the number of coins being held on centralized exchanges which are hitting a 19-month low according to the analytics company Glassnode.

The amount of $ETH held on centralized exchanges has reached a 19-month low pic.twitter.com/A6daguJmGK

— Bloqport (@Bloqport) March 22, 2021

The number of addresses holding more than 100+ coins is at the 19-month low and there are also liquidity droughts on DAI and WBTC as well which suggests that users are preparing to buy the bottom of the dip or are sitting out the round of volatility with an eye of the bigger profits in the near future. However, further down the cap tables, Ripple buoyed the calls for being relisted and surged more than 10% overnight. Uniswap too increased as well by 5% and Theta Token added another 12% to its token price with it breaking into the top 10 cryptos for the first time.

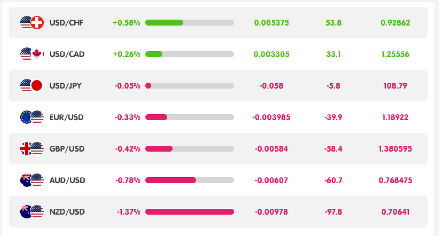

It looks like the improving strength of the dollar is having a negative impact on the cryptocurrency and the US recovery is making the dollar a safe haven for the investors with USD making gains against the EUR, GBP, and the Japanese Yen. There was also an influx of dollar buying after the Turkish Lira crashed by 15%. BTC advanced on the weakening dollar and the trade spat between the US, EU, and China which is also having an impact on the investor sentiment.

On Wall Street, the tech mega-caps saw major gains thanks to a pullback in the Treasury Yield growth rates as Apple increased by 2.8%, Microsoft by 2.4%, and Tesla by 2.2%. The tech stocks did gain and the travel companies and airlines also gained momentum in the recent weeks on the assurance that the world is getting back to normal and then crashed again since COVID won’t leave.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post