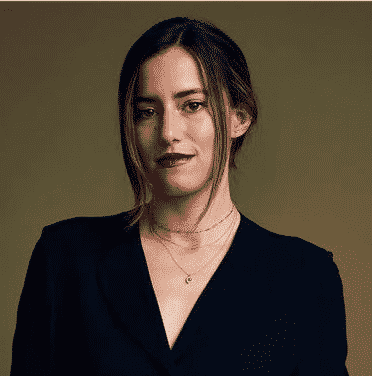

The BlockFi co-founder Flori Marquez believes that the Fear of Missing Out will be a major catalyst for driving crypto adoption next year as we can see more today in our latest cryptocurrency news today.

Blockfi co-founder expects FOMO to be the main factor that will drive digital asset adoption in the next year and noted that the two other elements will be the talent pivoting from traditional finance to the crypto industry as well as more regulatory clarity. In a recent interview with Yahoo Finance, Flori Marquez a who is also a Senior Vice President of Operations said that the digital asset industry has already grown to such a level that most people in the USA will experience the FOMO in 2022 and it will become the major factor for a lot of investors to enter the market for the first time and boost crypto adoption:

“We’re going to see more consumers across the US enter the space for the first time. And I think a huge driver is going to be FOMO.”

Marquez noted that right now, people are much more open towards altcoins and BTC compared to a few years ago. For example, she claims 1 in 10 Americans plan to give digital assets this year as a Christmas Gift while 2/3 prefer to talk about crypto:

“And I do think that crypto has become a bit more digestible for the average consumer than it was five years ago.”

According to Marquez, the second thing that will boost adoption next year is the “talent shifting” and said that the pandemic caused many experts to leave their positions and look for other job opportunities. BlockFi’s co-founder believes that crypto-related companies and fintech companies are very attractive options as the field presents long-term solutions:

“And honestly, crypto and fintech have been a huge attractor to people that are looking to learn something new and expand their careers. So I do think that we’re going to see more talent shifting from other more traditional industries into crypto and the fintech sector.”

The last thing that could boost the adoption in the next year is creating a regulatory framework because if the US watchdogs manage to solve this issue, investors and companies will feel protected to enter the market. Michael Saylor confirms this as well. The CEO of the company stated that clarity in the space will affect BTC positively as well as the other alternative coins while the institutional adoption will accelerate shortly after. He concluded that setting proper rules will decrease the BTC volatility and will raise the popularity in the public:

“There is a need for clarity. Crypto regulations and clarity in the industry would reduce the volatility in the bitcoin space and increase public confidence in bitcoin.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post