BlackRock CEO thinks the war in Ukraine could boost crypto adoption and can spur other countries to re-analyze their dependency on traditional payments infrastrcuture and fiat currencies so let’s read further in today’s latest cryptocurrency news today.

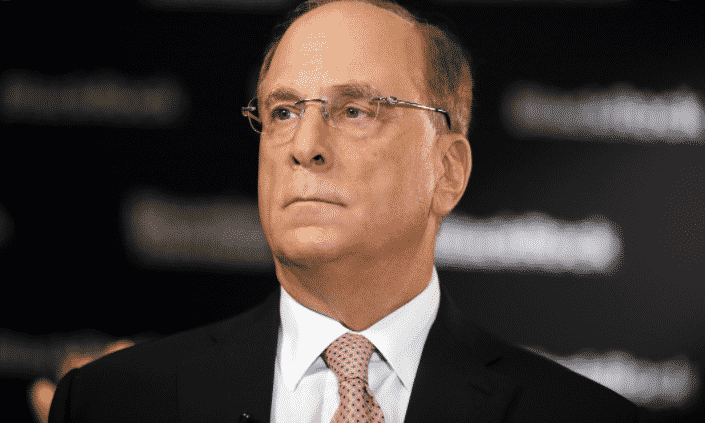

Larry Fink, the BlackRock CEO thinks the war in Ukraine could spur other countries to consider their dependency on the traditional payments infrastructure and could boost the crypto adoption as well. In a letter to the shareholders, the executive weighed in ont the impacts of the invasion and noted that it will boost the adoption of the digital assets.

buy kamagra soft generic buy kamagra soft online no prescription

Indonesia, Singapore, the UK, and Canada all resorted to regualting the digital assets while others like Pakistan, the USA, Brazil all proposed to regulate rather than impose a ban.

A few other countries already started to play a more active role in the crypto sector something which started even before the war started. However, Fink thinks that the global economic scenario could push forward a payment system that includes digital currencies. The CEO also added that a planned global digital payment system could revamp the international transactions while mitigating the risks related to money laundering and corruption and he even said that the digital currencies can cut down on the costs of cross-border payments:

“A global digital payment system, thoughtfully designed, can enhance the settlement of international transactions while reducing the risk of money laundering and corruption. Digital currencies can also help bring down costs of cross-border payments, for example when expatriate workers send earnings back to their families.”

To cater to the rising interest of the clientele, BlackRock is exploring digital currencies and the underlying technology. Fink hasn’t been quite vocal about the crypto industry in the past but remained uncertain on how BTC will play out over the long term. Despite expressing his fascination for the space, the executive considered himself to be more in the box with JPMorgan Chase’s Jamie Dimon who called BTC “worthless.”

The world’s biggest asset manager planned to roll out crypto trading services with the key to enter the digital asset space with the client support trading and then their own credit facility with BlackRock revealing that will enable market players to borrow the company by providing crypto as collateral. Last year, the investment giant reported $360K BTC gains after acquiring the futures contracts via CME.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post