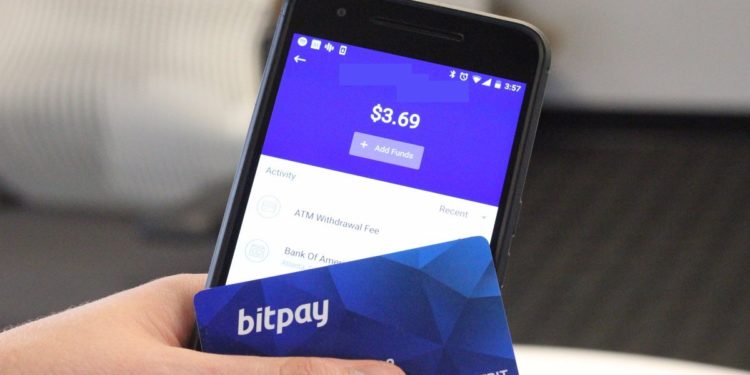

BitPay payment provider that is offering traders the opportunity to take crypto, launched support for some stablecoins. Users now have the possibility to use USD Coin, Gemini Dollar and Paxos paying for goods with every on-boarded merchants as we are reading in the latest crypto news.

The BitPay payment provider before specialized in letting sellers accept cryptocurrencies without the downside of exposure to the volatility that the cryptos are known for. The service is established in 2011 and it powers crypt-based checkout for traders throughout the globe. With buyers paying in cryptocurrency and the sellers receiving fiat currency on their bank accounts. ButPay is taking the burden of converting the cryptocurrencies to fiat currencies.

buy zocor generic https://mexicanpharmacyonlinerx.net/zocor.html over the counter

Payment in stablecoins should give a solution for one of the long-standing questions transacting with cryptocurrencies high volatility. BitPay earlier added stablecoin settlement options firstly aimed at merchants that live in regions with low banking infrastructure. For them, this was a huge improvement because the only option besides the stablecoins was Bitcoin (BTC) and Bitcoin Cash (BCH).

BitPay now has expanded that supporting benefits for users also. Wallet-to-wallet stablecoin transactions give the opportunity to harvest the most of the benefits of crypto for payments, speed, cost and control over funds, with little to no drawbacks. The addition of GUSD, USDC, and PAX makes the conditions for much bigger adoption of everyday cryptocurrency payments. But, one major item is lacking in the list-Tether.

Though USDT is the most important of the sablecoins in terms of volume and supply, it is lacking one very important core characteristic, regulation. Tether and Bitfinex came under fire more than a few times for supposed misrepresentation of its reserve coverage. While firstly marketed as a coin pegged to the US Dollar, the company later changed its disclosure to include “cash-like reserves.” A lawsuit filed by the Attorney General of New York furthermore alleged that Bitifinex has withdrawn a certain size of Tether reserves to remain solvent.

Nonetheless, Circle USD, Gemini USD, and Paxos are wholesomely transparent and regulated under the law of the United States of America. That could have been the determining factor for their enlistment and Tether’s exclusion by contrast.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post