Bitfarms’ shares crash after the NASDAQ debut following the bearish crypto market debut and despite the firm claiming that its profits increased amid the recent drop in BTC hash rate so let’s read more in our latest cryptocurrency news today.

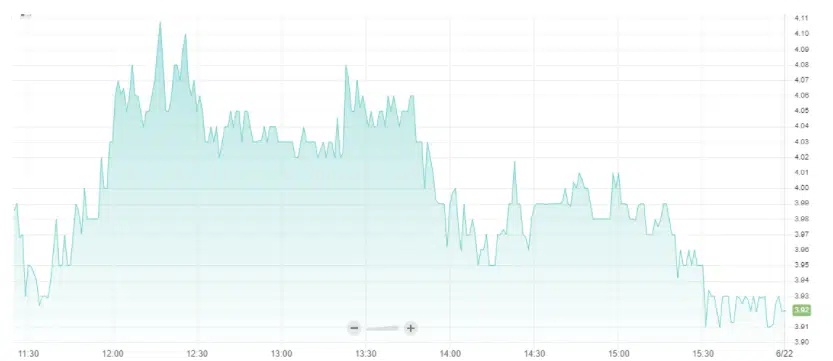

The much-awaited Nasdaq debut of renewable energy-focused BTC mining firm Bitfarms saw the company’s stock drop as much as 8.6% amid weakness in the broader markets. BITF opened at $4.04 and quickly climbed a few percent to a high of $4.11 before dropping to as low as $3.90 as the crypto prices tumbled. BitFarms’ shares crash as they traded hands at $3.96 and the share prices of the publicly-listed BTC mining firms took a beating over the past few months.

Marathon Digital Holdings or MARA got down 51% from its April ATH of $56.50 after its stock changed hands at $27.83 and HIVE Blockchain traded at $2.38 for a loss of 57% from the February high of $5.50 and Riot Blockchain priced at $31.57 after falling nearly 60% from the February peak of $77.90. In addition to the heavy BTC Sell-off that came after Bitcoin’s April ATH with the poor performance of the mining stocks resulting from negative perceptions concerning the sector’s energy consumption and reactions to China’s harsh crackdown on domestic miners.

However, Bitfarms claims to benefit from the recent hash rate exodus from China amid the clampdown with the Canada-based company estimating 99% of the computation being powered by the “green hydroelectricity” while Bitfarms company stated:

“As the hashrate of Chinese miners falls, Bitfarms has earned higher transaction fees and increased its share of the total Bitcoin network hashrate. As a result, Bitfarms has been earning more Bitcoin for the same amount of computational power and operational cost.”

Despite the massive crackdowns observed in the price of the mining stocks, reports showed that the sector outperformed the spot price of BTC by 455% during the preceding year.

As recently reported, Bitfarms’s goal is to reach 3.0 EH/s of hashing power and to increase it to over 8 EH/by the end of 2022 once the last shipment of machines arrives. Bitcoin’s current global hashing power is around 159 EH/s which means that Bitfarms will account for 5% of the hashing power if the values remain unchanged. The percentage will shrink but bitcoin’s hash rate could rise considerably. According to Bitfarms CEO Emiliano Grodzki because of the global shortage of wafers used in the semiconductors, the supply of miners remains a huge challenge for the near future.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post