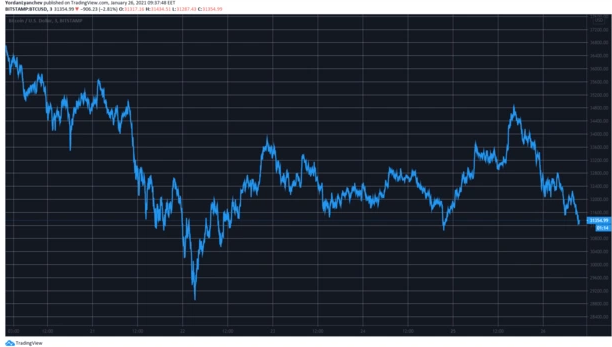

Bitcoin lost $4000 in one day with the total market capitalization plummeting to $930 billion as most altcoins followed the crash. In our latest BTC news, we are reading more about the price analysis.

After the false breakout, BTC retraced once again and now has a hard time maintaining the levels above $31,000 while most alternative coins followed the move, and the total market cap lost about $80 billion in one day. The primary cryptocurrency saw better days as it lost about 15% in one week. A few days ago, it dropped below $29,000 while it did seem that the trading session from a day ago will be more bullish but the situation reversed. BTC initiated a leg up which resulted in a daily high of ,000 but the bulls were preparing for a new increase that the bears took charge of and led the asset on the downtrend again.

buy grifulvin online https://www.gcbhllc.org/files/new/grifulvin.html no prescription

In the next few hours, Bitcoin lost $4000 of value and it then dropped to $31,000 with the technical indicators suggesting that this is the first major support level that will contain the retracement. If BTC breaks below it, the next one is at the $30,760 level before potentially relying on the $30K level as a psychological level. Most of the coins made serious gains in the past few days and even managed to reduce Bitcoin’s dominance over the market but they followed again through the correction.

Ethereum lost more than 7% and now struggles at the $1300 level, Ripple dropped by 6%, Bitcoin Cash by 6% as well, Binance Coin by 4%, Cardano by 4%, Chainlink by 8%, Polkadot by 7%, and Litecoin as well by 7%. The situation among the lower and mid-cap altcoins is far worse. NEAR protocol lost the most on a 24-hour scale with a 17% drop. Sushiswap lost about 14%, Compound lost 13%, Reserve Rights dropped by 13%, Synthetix by 12% as some of the examples. There are several impressive gainers as well like Horizen that increased 24%, Nervos by 22%, and Decred by 12%. The cumulative market cap of all assets decreased by about $80 billion in a day to $930 billion.

As reported a day ago, the market sentiment for the dollar is bearish and pushed the BTC anti-fiat narrative among speculators because of the negative correlation with one another once the COVID imposed a crash in March which the altcoins followed.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post