Bitcoin dips below $41K as the crypto landscape still remains unfavorable for most cryptocurrencies, in the first week of the new year. In today’s latest Bitcoin news, we are taking a closer look at the price analysis.

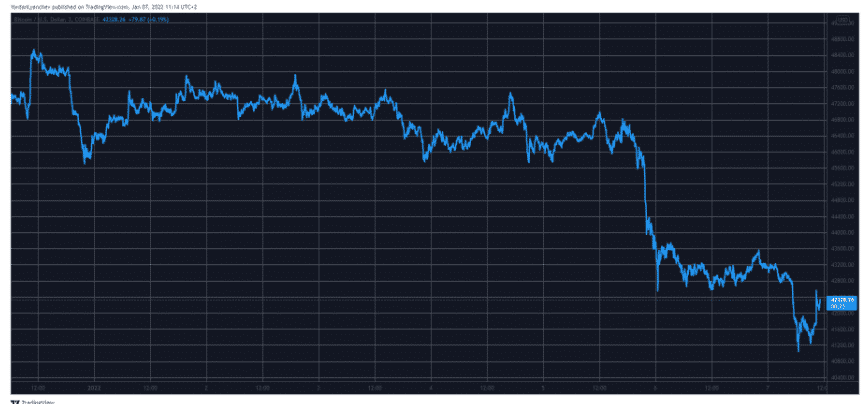

After yesterday’s crash on the market, Bitcoin is still not out of the woods as the asset crashed to $41,000 hours ago. Most altcoins followed a similar pattern with a few exceptions like ATOM which increased 16% in one day. The reports show that the substantial market crash where the main cryptocurrency crashed by double-digit percentages from $47,000 to below $43,000, it still ongoing. This came after a few days of sitting calm near $47,000 but following the drop, Bitcoin remained above its intraday bottom with the situation worsening hours later.

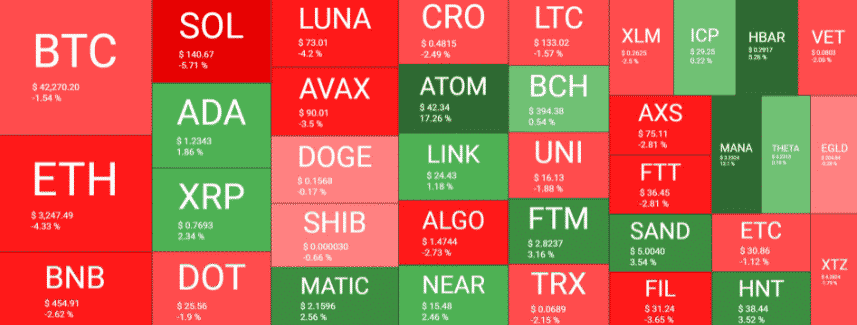

Bitcoin dipped below $41K and lost $2000 of value. Since then, BTC reclaimed some ground and touched the $43,000 price before getting rejected again and pushed to over $42,000 where it now sits. As such, about 2% down on the day, the market cap declined to $800 billion. The alternative coins suffered just as bad and most are in a similar position today as well. Ethereum traded above $3800 a few days ago but dumped below $3400 yesterday. Another 4% drop since then drove the second-biggest digital assets to $3250.

Binance Coin dropped by 2.5%, Solana by 6%, Terra by 4%, Polkadot by 2%, Avalanche by 3.5%, and DOGE and SHIB also being in the red together. Ripple, Cardano, and MATIC were among the rare ones that made minor gains. ATOM outperformed all other larger and middle cap altcoins with a 17% increase and now the token is sitting above $40. other smaller-cap altcoins like Counos X surged in value but the crypto market is still down to $2 trillion which means more than $250 billion was lost in two days.

As recently reported, Bitcoin’s market dominance reached lowest level since 2018 and it stands at 37.28% and the last time it was this low was back in 2018 during the harsh bear market when it dipped to as low as 33%. Market dominance refers to a crypto’s share of total market cap with the entire crypt market cap now standing at $2.3 trillion. Bitcoin’s market cap is now set at $871 billion, below the November $1.27 trillion. The reason for the larger drop is quite simple: investors are looking at other coins as one crypto trader and analysts noted, that there’s little demand for Bitcoin from the retail investors at the moment.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post